California's SB 1327 and the Big Tech astroturfers of the weekCalifornia wants Big Tech to pay for local journalism. The legislative fight hasn't been completely fair.

In the last few days, we’ve been blessed by the appearance of one of Big Tech’s most brazen astroturf groups as the industry fights two bills that would require tech monopolies to return some of their profits to local newsrooms. The Connected Commerce Council has released a letter signed by around 150 California small businesses expressing deep concerns about SB 1327 taxing the data-mining that powers Big Tech’s unbelievably lucrative digital advertising network. I found this letter quite interesting, for reasons that have nothing to do with the text:

The concern is that if California taxes a tech giant’s ad revenues, the big guy will just pass the added costs on to these small business owners so that Mom and Pop are the ones footing the bill. Sounds bad, right? Except I spent the weekend looking up each of these 150 businesses on the Google Ads Transparency Center and Meta Ad Library, and most of them have little record of currently or recently advertising on the two biggest advertising platforms targeted by this bill. The lack of advertising was so glaring that I even made a spreadsheet. If these are the folks most worried about pass-through costs, Google and Meta’s own data suggests they have little reason to worry SB 1327 will “hurt our families, employees, and our opportunity to succeed and help grow California’s economy.” Nonetheless, I tip my hat to Carbon Black, subsidiary of Broadcom (market cap: $734 billion), for slipping onto the list of signatories in solidarity with the little guy. I did find a handful of businesses that advertise with Meta or Google regularly, and I take them at their word that they’re concerned about getting screwed by Big Tech. These folks are already getting taxed — by Google. Several of these businesses appear to have placed buys in the text advertising market where U.S. District Judge Amit Mehta ruled last week that “Google in fact has profitably raised prices substantially above the competitive level” as an unlawful monopoly. Are you an investor enjoying Google’s $2 trillion market cap? Well, here’s where it came from: the plumbers and the bike shops on Main Street paying above market rate. If the argument is that a unlawful monopoly might ruthlessly hike its unlawful prices on these businesses even higher, then I guess I believe them. I’m just glad we have a U.S. Department of Justice closely watching for these kinds of developments. What’s a little more morbid is the presence of the front group, Connected Commerce Council (3C), that arranged the support of these signatories. From the Tech Transparency Project in 2019:

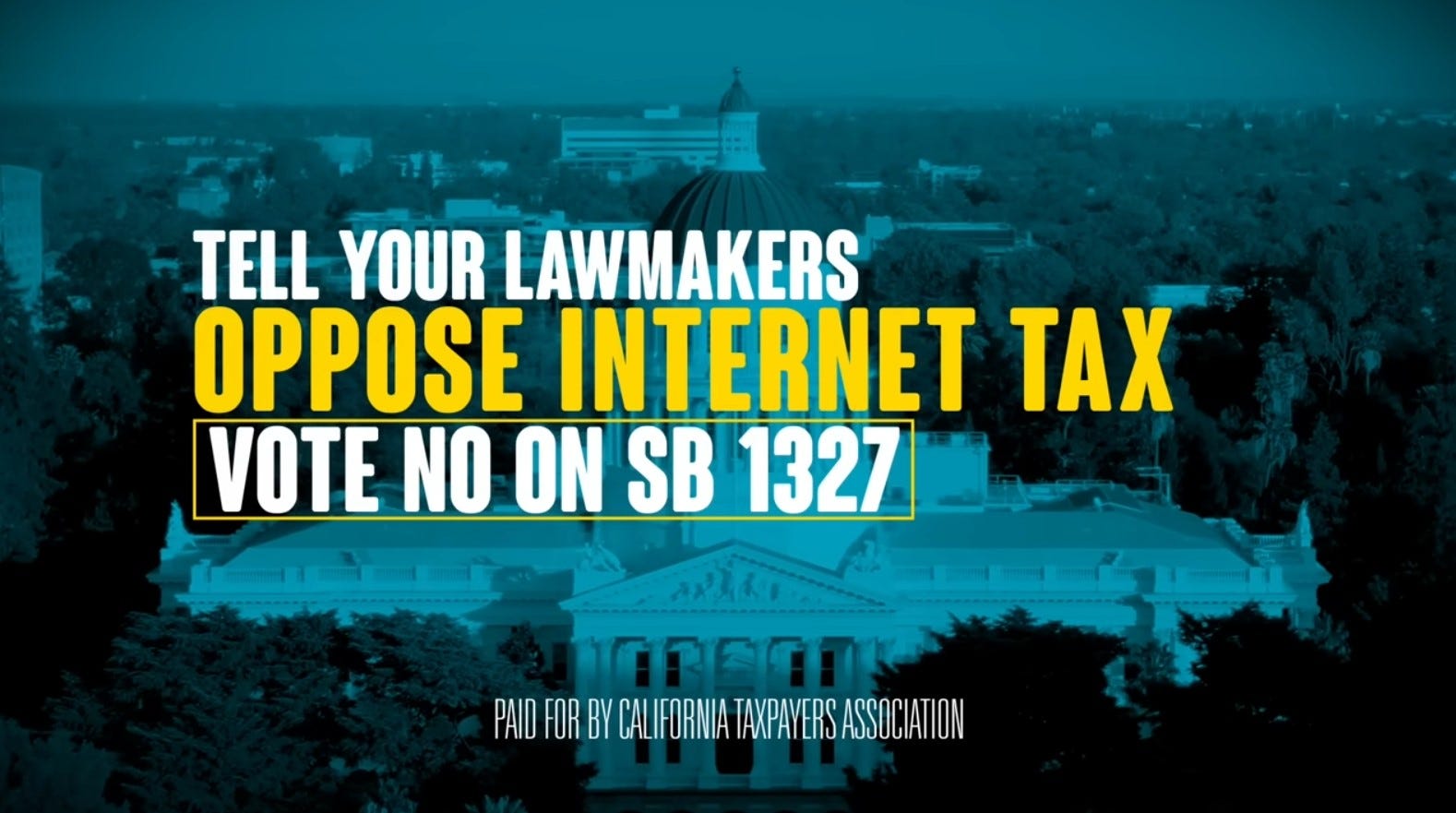

I’ve written previously about the creepy Big Tax propaganda ads irradiating the airwaves and social media ads in California, which largely consist of foxes organizing hens against henhouses. Don’t buy it. Either AB 886 or SB 1327, if passed in their current form, would mark the most significant American investment in journalism since the creation of the Corporation of Public Broadcasting. The state’s major journalism unions, including mine, think that sounds dangerously akin to actually accomplishing something. The tech industry must think so too, if this is the kind of fight it’s waging. Matt Pearce is free today. But if you enjoyed this post, you can tell Matt Pearce that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |