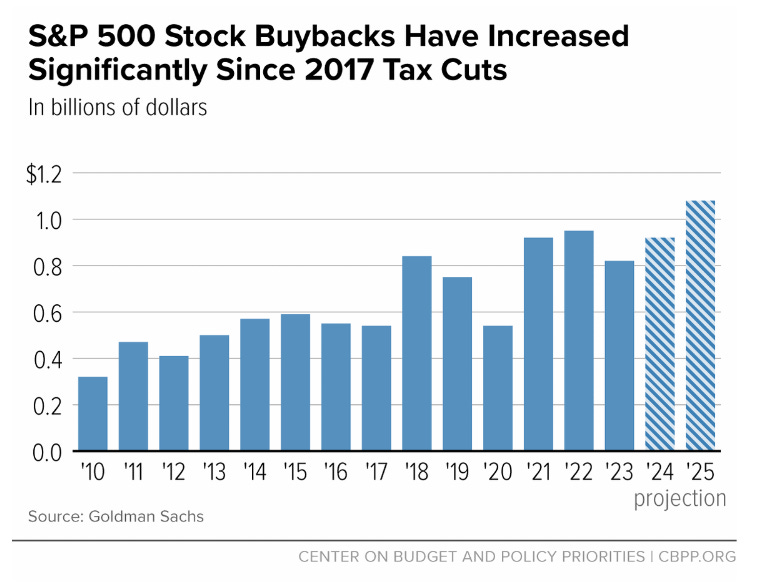

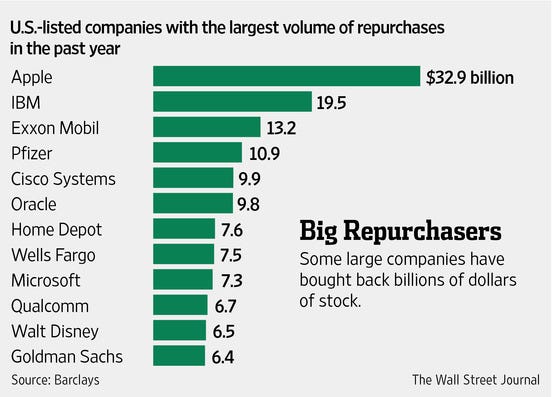

Welcome to You’re Probably Getting Screwed, a weekly newsletter and video series from J.D. Scholten and Justin Stofferahn about the Second Gilded Age and the ways economic concentration is putting politics and profits over working people. Welcome to You’re Probably Getting Screwed, a weekly newsletter and video series from J.D. Scholten and Justin Stofferahn about the Second Gilded Age and the ways economic concentration is putting politics and profits over working people. With all the focus on how corporate power has been driving up costs for Americans you might think the largest firms would be considering how to utilize records profits to lower costs, increase wages or even put money into innovation. Instead, corporations are planning to pour money into stock buybacks, which are projected to exceed $1 trillion for the first time ever in 2025. Stock buybacks are exactly what they sound like. A company buys up its own shares which then boosts the stock price. Put another way by Illinois Congressman Sean Casten, buybacks are “the process by which top executives at a company reward themselves handsomely for not producing what their company is alleged to produce.” Stock buybacks are a defining feature of today’s financialized and highly consolidated economy that is stripping companies for parts. Just look at Boeing, which has used its dominant market position to screw workers and build planes that fall apart. Between 1998 and 2018 Boeing executed $61 billion in stock buybacks which amounted to over 80 percent of the company’s profits, enriching Boeing CEOs and the investment firms that own much of its stock. What did Boeing not spend money on? Workers! The company has laid off around 45,000 workers between November 1998 and January 2024. Money also clearly has not been put into building better planes or even ones that work as they are intended to. Last week Vice President Kamala Harris gave a major address laying out several key pieces of her economic agenda. A core piece of that are proposals intended to deal with the high cost of groceries (which are up 25% since the pandemic as we talked about two weeks ago). This includes passing a federal law prohibiting price gouging like 37 states already have and cracking down on price-fixing. While corporate mouthpieces at the Wall Street Journal and CNBC have gone crazy over the proposals by Harris, retailers and chain restaurants are helping prove her point. While major retailers like Target and restaurant chains like Applebees have seen their costs moderate or even decline recently, that savings is not being passed along to consumers, but is being used to fuel more stock buybacks. According to Bloomberg, consumer discretionary and consumer staples firms in the S&P 500 increased spending on share buybacks in the fourth quarter by 53% and 80% respectively.” You are getting screwed to the benefit of Wall Street. Stock buybacks might have become commonplace, but they are an ahistorical financial engineering project. In 1982 just two percent of corporate profits went into stock buybacks but today that share has skyrocketed to 70 percent. This change was driven by policy. Prior to 1982 stock buybacks were mostly prohibited and seen as a form of stock manipulation, but the SEC under President Reagan eliminated that prohibition as part of its broader effort to eliminate antimonopoly protections. The companies that benefited from this change were not the small businesses that power main street, but some of the country’s most dominant corporations. Big Tech monopolists have been claiming that the crackdowns on their anticompetitive behavior by the Federal Trade Commission and the Department of Justice will reduce innovation. Yet in recent years companies have spent much more on stock buybacks than they have on research and development. In an antitrust lawsuit, the Department of Justice has noted that Apple’s share buybacks have dwarfed its research and development spending. More competition in the economy would force companies to utilize their profits to pay workers more or invest in their companies through innovation or building new factories. Instead extreme consolidation has joined forces with financialization and created an economy no longer based on building things, but on manipulation and financial tricks. There is an easy fix to this problem. Congress should reverse the 1982 SEC ruling and ban companies from buying back their stock on the open market. YOU’RE PROBABLY (ALSO) GETTING SCREWED BY:Corporate Price Gouging Corporate profits are driving high costs even as input costs are declining. Groundwork Collaborative has a new “Corporations Are Driving the High Prices” fact sheet. Judges Back in April, the Federal Trade Commission (FTC) issued a final rule that would promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation. 'Free' Job Training Definition of “Freedom” Rural Internet Access U.S. Census data says American producers saw moderate improvement in internet access has increased from 75.4 percent in 2017 to 78.7 percent in 2022, but that still about 1 in 4 farmers don’t have access to the internet. SOME GOOD NEWSHow the Government Can Ban Price Gouging Here’s a breakdown of how price gouging bans would actually work. BEFORE YOU GOBefore you go, I need two things from you: 1) if you like something, please share it on social media or the next time you have coffee with a friend. 2) Ideas, if you have any ideas for future newsletter content please comment below. Thank you. Break ‘Em Up, Justin Stofferahn |