Monopoly Round-Up: Did the Death Blow of Hollywood Just Happen?With a proposed Paramount acquisition of Warner Bros Discovery by a Trump ally, the media and the movies are quickly consolidating into the hands of GOP oligarchs. Will there be pushback?Today’s round-up has lots of stuff to go over, including some bad numbers on the economy, Kamala Harris’s boneheaded public comments on the election, and a turducken of corruption as UnitedHealth Group amps up its lobbying to ward off criminal investigations by the Department of Justice. Normally I divide up the news into a main theme, and then after the paywall I have a list of good and bad news. I’m adding a new section, which is called Questions. I’ll put things there that I’m researching or questions on my mind. If you know the answer or have thoughts, chime in! This week, the big news is the consolidation in Hollywood, through two important deals. The first and most important is the combination of Paramount and Warner Bros Discovery, financed by the sometimes-richest man in the world, Oracle founder Larry Ellison, who is also a close Trump ally. This deal, aside from crushing Hollywood bargaining power, is political, fusing the interests of the Republican Party with the corporate media. The second is Amazon working with Netflix in advertising, after doing a similar deal with Disney. This deal will create a cartel of the three dominant streamers in TV streaming ads. We’ll start with the more high-profile Paramount buying Warner Bro. Discovery. This acquisition is the second purchase by Skydance, run by David Ellison, who is Larry’s son. The first was Skydance’s acquisition of Paramount, which took a painful near-year to complete. Skydance and Paramount aren’t competitors, but despite the lack of obvious legal problems, the Trump Federal Communication Commission imposed significant obstacles. Why? The company owns CBS, with a bevy of politically liberal voices that FCC Chair Brendan Carr likely sought to silence. Paramount and Warner Brothers are, of course, also important movie studios. So what of the view from Hollywood? The most important writer in Hollywood, Richard Rushfield, offered it up in a piece yesterday titled “Warnermount: Is Anyone Awake Out There to Stop This?” Rushfield points out the initial Skydance-Paramount deal was pitched to the community as an ugly compromise. Hollywood had to swallow “settling [Trump’s] ridiculous lawsuit, throwing 60 Minutes under the bus,” as well as “firing Stephen Colbert, killing CBS News’s independence, offering Trump free ad time, and buying Trump favorite the UFC.” But, he noted, “at least we were keeping Paramount intact as a studio, making films and releasing them to theaters, and presiding over some amount of streaming production. It was better than the very real alternative of the company being stripped down and sold off for parts.” But then, in a Lando Calrissian-esque “this deal is getting worse all the time” moment, Ellison, after closing on the Paramount deal, immediately sought to buy Warner Bros, which will likely be closed down. Here’s Rushfield:

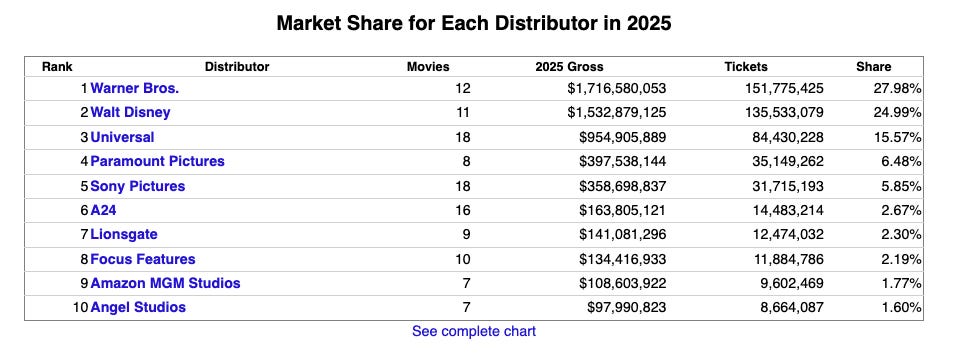

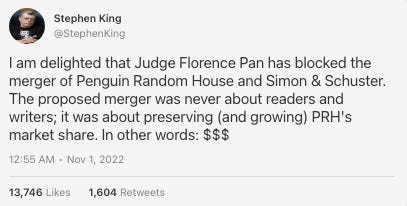

One political question is whether Hollywood executives, agents, actors, writers, unions, and cameramen will speak out in any coherent way against consolidation. So far, over the past 30 years, no one really has, though during the strikes in 2023 the conversations heated up somewhat. A different political question is whether the equally moribund Democratic establishment will notice that this merger is happening, and seek to stop it. They were angry at the cancelation of Stephen Colbert’s show, and would not particularly like CNN being under Trump’s thumb. On the other hand, opposing this deal would mean doing something, and Democrats hate that. So that’s the politics. Now let’s talk law. While discussing merger law seems kind of adorable now that we’re in a land of lawlessness, there’s a reason to ask whether this deal is legal. And that is, state attorneys general have the ability to challenge it, even if Trump’s Antitrust chief Gail Slater, a deeply meek official after being disciplined by MAGA corporate lobbyists, will almost certainly not. Will Democratic state officials? Maybe. I asked former DOJ antitrust attorney Hetal Doshi, who is running for the Colorado attorney general office, which has jurisdiction here. These kinds of “modern media companies,” she said “now wield power in nearly every aspect of public life: journalism, movies, television, and beyond; That is why any multibillion dollar merger that further consolidates power in this industry should be carefully scrutinized.” State enforcers, she noted, “have both the authority and responsibility to investigate.” Doshi is a careful lawyer, so these words carry significance. In other words, enforcers are keeping a close eye on this one. Is there a case? Well first let’s look at market share numbers, which suggest this merger would be problematic. There are five major studios today - Disney, Universal, Sony Pictures, Paramount Pictures, and Warner Bros - and this deal would combine two of them, bringing a market of five players who compete head-to-head to four. Just a few years ago, there were six, but after Disney bought Fox, it shrank to five. In 2025 theatrical releases, so far Warner is number one and Paramount is number four. If you look at the 2023 merger guidelines, which have been recognized as authoritative by more than a dozen judges, you can see right off the bat that this deal can be challenged. I count five different guidelines that it could violate. It’s a merger in a highly concentrated industry (guideline one), it would eliminate head-to-head competition (guideline two), it’s part of a consolidating trend (guideline seven), it is part of a series of acquisitions in a market (guideline eight), and it combines buyers and could lessen competition for “Workers, Creators, Suppliers, or Other Providers” (guideline ten). And that’s not even getting to other parts of the companies, like the fact that they both have streaming services. So what would the case look like? In most merger cases, people assume that the merging parties would be able to raise prices to consumers and lower output. And certainly, the number of movies in theaters have collapsed as the studios consolidated. But in this case, a key argument will also be that these companies could lower compensation to suppliers, aka writers, actors, cameramen, and so forth. Has such a merger challenge ever happened and succeeded? In fact, yes. Going at Paramount-Warner would be quite similar to the Penguin-Simon & Schuster merger that Biden antitrust chief Jonathan Kanter blocked in 2022, on the grounds that writers would get paid less for their work if the merger went through. Here’s Stephen King, a star witness at trial, celebrating the decision by Judge Florence Pan. If Paramount-Warner Bros Discovery goes to trial, we can expect similar star power on the stand, as well as the public being able to read the emails of a whole set of powerful media barons colluding with political actors. It would be in some ways the merger trial of the century. There’s a direct line between the two cases. Doshi, for instance, led the DOJ team challenging the Penguin-Simon & Schuster merger. Tonight, she told me she’s paying attention here, because “narrowing the number of meaningful players in this space raises serious questions about the impact on workers and jobs in creative industries as well as on audiences who may find fewer new voices able to break through and fewer choices overall." In other words, the talent trained in the last few years is now ready to go here. There are some differences between five book publishers merging to four and five movie studios merging to four. An obvious one is that there are other powerful companies who make video content, like Amazon, Apple, and Netflix. But Rushfield pointed out those streamers, while dominant, aren’t significant players in theatrical releases, and aren’t interested in becoming players in that market. Now I’m sure that the Paramount-Warner Bros Discovery proponents will talk about needing to compete with big tech, and AI, and how this merger will increase competition rather than reduce it. We’ve seen that kind of jazz hands repeatedly. It’s the rationale for why Judge Leon approved the AT&T-Time Warner deal in 2018, as he felt the two firms combined would better challenge Google and Facebook. Because of examples like Leon, some judges have learned that they should in fact block mergers. The question is whether there will be some state attorneys general, like California’s Rob Bonta, New York’s Tish James, or perhaps Colorado’s Phil Weiser, who could act independently of the compromised Trump Department of Justice. So that’s the story one. The second big piece of news is the deal between Amazon’s advertising business and Netflix, which comes on the heels of a separate identical deal with Disney.

Amazon, Disney, and Netflix, who are by far the largest streamers, could be in the midst of forming a cartel in TV streaming ads. The Paramount-Warner Bros Discovery deal is certainly the high-profile politically sensitive one, but as one extremely savvy business analyst told me, this ad alliance may in the end turn out to be more important. And now, the rest of the round-up. CVS’s former President is running for Governor of Rhode Island as a Democrat, Zohran Mamdani goes after surveillance pricing for World Cup tickets, and an astonishingly great legislative session in California as that state regulates how platforms can price-fix, which is quickly becoming the basis for how the economy works. Plus, the economy is softening as empty cardboard box data - a surprising indicator - is at a ten year low. That and more after the paywall. Oh, and if you want to know why you should join as a paid subscriber, the answer is not just the extra content, which I’ve been told by many of you is quite useful. Between 100-200k people read each issue of BIG, and we have accomplished enormous amounts together. I finance this work through your subscriptions, so if you think fighting monopolies is useful, you should consider subscribing. ... Watch with a 7-day free trialSubscribe to BIG by Matt Stoller to watch this video and get 7 days of free access to the full post archives. A subscription gets you:

|