|

Hello friends and enemies! Before we dive in to the crypto news: I am auctioning off the ten numbered prints of “Free people read freely”, the linocut relief print I created and used in the previous issue of Citation Needed. All proceeds will go to the Internet Archive’s Open Library. If you’re interested in bidding on one, you have until September 20. If you would like to print your own copy or use the image to create something else (stickers? t-shirts?), there’s a high-res, freely-licensed scan on Wikimedia Commons. Go wild. In the courtsFTX

Sam Bankman-Fried has filed an appeal, arguing to the Second Circuit that he deserves a new trial because he was “presumed guilty by the judge who presided over his trial”.1 His lawyers argue that Judge Kaplan’s rulings on which evidence to allow and which arguments could be presented, as well as his “biting comments” made in front of the jury, demonstrated partiality and denied Bankman-Fried his right to a fair trial. They also continue to attempt the “no harm, no foul” argument, claiming that “FTX was never insolvent, and in fact had assets worth billions to repay its customers”, which they say should have been presented to the jury. They repeat that Bankman-Fried didn’t mean to “cause loss” to his customers and investors — a mischaracterization of the intent requirement in the relevant law.2 They’ve asked for the judgment to be reversed and the case re-tried in front of a new judge.

This seems like a pretty steep uphill battle for Bankman-Fried. Appeals courts already rarely reverse lower courts’ decisions, and even more rarely reverse and reassign them to a different judge based on arguments of judicial bias. There is a high bar for this type of thing, and a Supreme Court decision has even noted that “Not establishing bias or partiality, however, are expressions of impatience, dissatisfaction, annoyance, and even anger, that are within the bounds of what imperfect men and women, even after having been confirmed as federal judges, sometimes display.”3 The examples Bankman-Fried’s lawyers provide of Kaplan’s supposedly “mocking” behavior seem pretty well within the norms of often cranky federal judges, with the appeal citing a fairly benign instance in which Kaplan asked Bankman-Fried’s somewhat bumbling defense counsel to discontinue a line of questioning during cross-examination:

Equally troubling, [Kaplan] repeatedly mocked defense counsel and discredited their cross-examinations in front of the jury. E.g., A-756 (“let’s stop that, please”; “What part of ‘let’s stop that’ was obscure?”); A-745 (“Could we get to the point.”); A-879 (“This is not an exam for new eyeglasses. I assume he can read it just as well as everybody in the jury box can read it…You can ask him who Johnny Podres was. Let’s move along. He pitched for the Brooklyn Dodgers.”).

Though I and others regularly commented on Kaplan’s apparent frustration throughout the case, much of it seemed to stem from Sam Bankman-Fried being... well, frustrating. While Bankman-Fried might appreciate a ruling that you can get another trial if you simply annoy the judge enough, I suspect that’s not a terribly likely outcome. FTX executive Ryan Salame appeared before Judge Kaplan for a hearing on his petition to either force the government to drop their prosecution of his partner, Michelle Bond, or to vacate his conviction [I65]. Although Salame had tried to withdraw the petition about a week after filing it (reasoning that it would be better argued in Bond’s case), Kaplan refused the request.

In the hearing, Kaplan was reportedly “visibly annoyed” at Salame. He repeatedly expressed that, because Salame had lied during his plea allocution when he confirmed that he was not pleading guilty based on promises outside of the written plea deal, his conviction and sentence were “based on false testimony”. He also noted that Salame could be further sanctioned for lying under oath.4 Kaplan made no decisions during the hearing, instead opting to take some time to consider how to proceed.

CelsiusThe criminal trial of Celsius CEO Alex Mashinsky is set to begin today, on September 17. For those who need a recap, I wrote an overview of the company’s collapse and an ensuing bankruptcy examiner’s report in February 2023: The Celsius bankruptcy proceedings have wrapped up, with customers receiving a combined $3 billion in payouts, plus shares in a new bitcoin mining venture called Ionic. This is estimated to be an approximately 67% recovery, although this is dependent both on the success of Ionic (which is already having troubles, as I explain later in this issue) and on the success of criminal and civil cases against Mashinsky [I43]. In July 2023, Mashinsky was arrested and indicted on seven charges involving fraud and manipulation of the CEL token price. The SEC, CFTC, and FTC simultaneously filed civil cases against him [I33].

If convicted on all criminal charges, sentencing guidelines suggest he serve what is effectively a life sentence. A recent filing by Mashinsky previews his defense: that he did not intend to defraud or harm anyone, and that he was merely relying on the advice of those around him. As for the token price manipulation, he plans to argue that his employees were trading CEL tokens against his instructions and without his knowledge.5

If I’m ever a CEO, I hope I have employees who are so incredibly loyal that they will secretly do things that earn me tens of millions of dollars in profits. Everything else

A class-action lawsuit filed against Atomic Wallet in a Colorado court has been dismissed after the judge found that the Estonian company’s presence in Colorado was not sufficient to establish jurisdiction.6 Users of Atomic Wallet lost roughly $100 million in June 2023 in a spate of thefts later attributed to North Korea’s Lazarus Group [W3IGG].

Coinbase had less success in having dismissed a four-count shareholder complaint alleging the company downplayed the likelihood they would be sued by the Securities and Exchange Commission. The judge dismissed a portion of one of the counts, but otherwise allowed the case to go through. He stated that the plaintiffs had adequately argued that Coinbase had “misleadingly described a favorable picture of the improbability that the SEC would file an enforcement action by repeatedly emphasizing that the crypto assets they listed were not securities,” and had failed to disclose the risk that customers could lose their assets in the event of a Coinbase bankruptcy.7

The leader of a group of violent, bitcoin-seeking home invaders [I61] was sentenced to 47 years in prison.8

In bankruptcies

Ionic, the bitcoin mining firm that was created in February out of the wreckage of the Celsius collapse in hopes of compensating creditors with its profits, is already facing challenges [I43, 50]. Ionic’s former CEO left the company in July, and plans for the company to go public (which would give Celsius creditors the option to sell their shares) were delayed. Now, Ionic shareholders have forced a board meeting and issued a statement suggesting that the board is not operating with the shareholders’ best interests in mind and accusing board members of misconduct. “This isn't a company that should have ever existed,” said one former Celsius customer and now Ionic shareholder to Decrypt. “To say that shareholders have no confidence would be the understatement of the century.”9

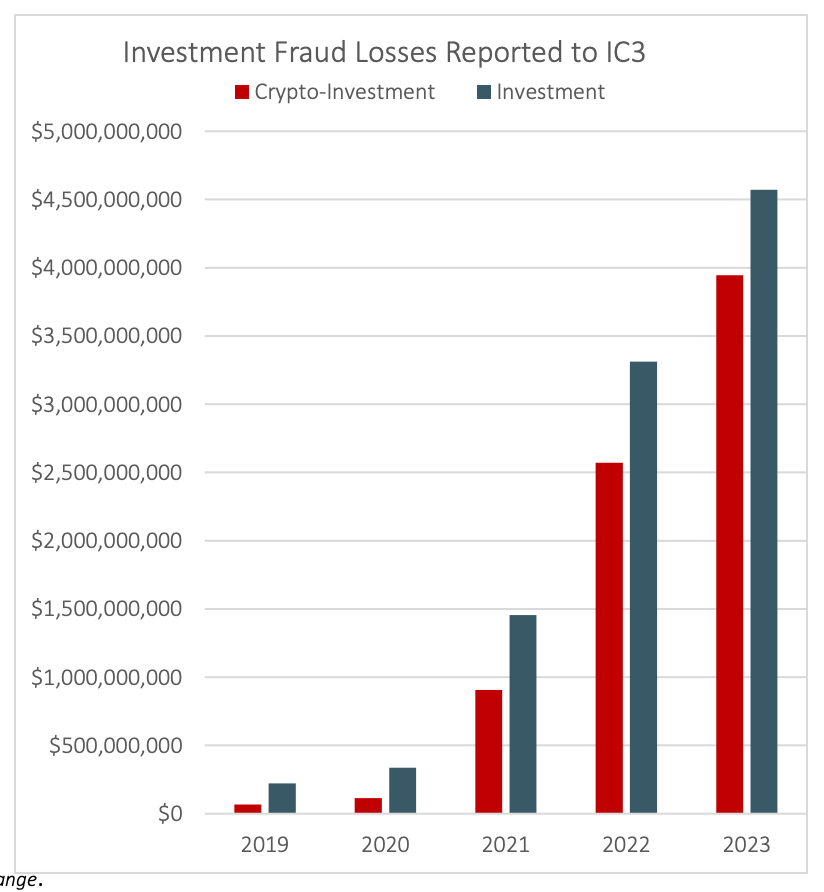

In governments and regulatorsAn FBI report on internet crime in 2023 found there had been $4.57 billion in losses to investment frauds that year, with $3.96 billion of it (87%) being crypto-related.  A judge ruled that the CFTC had overstepped when blocking the Kalshi non-crypto-based prediction market from offering contracts pertaining to the US elections. According to the judge, those contracts do not involve “unlawful activity or gaming”, and thus are not within the CFTC’s remit.10 Kalshi listed its first election prediction markets the very same day as the opinion was published. The CFTC almost immediately applied for an emergency motion from the DC Court of Appeals to prevent Kalshi from offering these contracts while the agency prepared their appeal, arguing that any potential financial harm Kalshi might suffer from not being allowed to offer these contracts would be outweighed by the “acute risk of short-term manipulation of election markets and threats to election integrity”.11 The appeals court granted a temporary stay while the emergency motion is considered, and consequently Kalshi paused trading on those election markets as they fight the order.12

Although Kalshi doesn’t have any crypto involvement of its own, this case potentially sets the stage for future regulatory moves towards offshore crypto prediction markets like Polymarket, where almost $1 billion in bets have been placed on the outcome of the US presidential election alone. Polymarket has come up in the Kalshi court case, with the CFTC citing a blog post by a Columbia economics professor describing “a spectacular attempt at manipulation on Polymarket” with respect to its presidential election market and a derivative market.13

Uniswap will pay $175,000 to settle charges from the CFTC that they were offering illegal leveraged and margined commodities transactions. Both the order and the settlement were announced on September 4.14

Among the digital assets traded on the protocol and through the interface were a limited number of leveraged tokens, which provided users leveraged exposure to digital assets such as Ether and Bitcoin. The order finds these leveraged tokens are leveraged or margined commodity transactions that did not result in actual delivery within 28 days and therefore can be offered to non-Eligible Contract Participants only on a board of trade that has been designated or registered by the CFTC as a contract market, which Uniswap Labs was not.

This is only the latest in Uniswap’s regulatory woes. Venture capital firms including Andreessen Horowitz and Union Square Ventures have reportedly been subpoenaed by the New York Attorney General as part of an investigation into Uniswap.15 These subpoenas are separate from the reported subpoenas sent last month to venture capital firms by the Securities and Exchange Commission [I64], which had also sent a Wells notice to Uniswap in April [I55]. Those earlier subpoenas now appear to have also been related to Uniswap and directed at Andreessen Horowitz and Union Square Ventures, according to Axios.16

The Federal Reserve sent a cease and desist order to United Texas Bank after an examination revealed governance issues and “significant deficiencies” pertaining to foreign correspondent banking and digital asset customers. This follows a recent action against Customers Bancorp in Pennsylvania, which focused on the bank’s “digital asset strategy”.17

In elections and political influence

Some crypto advocates were dismayed at the lack of any mention of cryptocurrency during the first (and likely last) presidential debate. Ryan Gorman, partner at a web3 PR company, wrote in an op-ed in CoinDesk that “Neither the American public nor the two presidential candidates care very much about crypto.” The subhead read, “Despite the industry’s pretensions to relevance, most people don’t care about these issues.”18

Trump crypto projectRather than preparing for another debate or campaigning, Trump has been preparing for the launch of his family’s World Liberty Financial crypto project, which kicked off with a torturous livestreamed audio interview on Twitter. Few, even in the crypto world, seem excited about this project. Many seem concerned that it could worsen crypto’s already grifty reputation. The livestream was produced in partnership with “Rug Radio”, making me wonder if the programmers of our shared simulation have given up entirely. It began with twenty minutes of Trump recounting to the audibly starstruck self-described “crypto bro” interviewer the stories of his attempted assassination in July and the more recent incident in which a man with a rifle was discovered hiding in the bushes of the golf course where Trump was playing. The conversation eventually meandered around to the intended subject, with Trump speaking vaguely about how his children changed his mind on cryptocurrency, which he said “is one of those things we have to do whether we like it or not”. Although Trump departed the stream around forty minutes in without ever touching on the specific World Liberty Financial project, the conversation continued almost another two hours, with a cast of characters including Eric Trump, Donald Trump Jr., and several other key figures in the project. Despite the length of the conversation, details about World Liberty Financial remained scant, with much of the conversation devoted to general talking points about the potential for crypto to help those who face challenges in getting access to financial services. Several figures in the crypto world remarked on how the conversation felt like a flashback to the starry-eyed and largely substance-free conversations from early into the 2020 hype cycle, when many waxed poetic about the potential for cryptocurrency to “democratize finance”. Personally, I think it’s telling that the first time anyone in the Trump family has expressed concern about equitable access to financial services is when they’re hawking their crypto project. The project seems to be a borrowing and lending project similar to Aave, an Ethereum-based protocol first launched in 2017. Critically, the “loans” on Aave are overcollateralized loans, meaning that a borrower must supply more assets than they’re borrowing — making the project useful to those who hold substantial amounts of crypto and want to borrow against it rather than sell it, but not helpful to most people who face challenges accessing credit in the real world, where people generally take out loans because they don’t have the assets required for whatever it is they’re trying to do. Hours in, the team also confirmed that the project will eventually launch a token, which will be non-transferable, won’t provide any economic rewards, and will only available to accredited investors. Despite the overall lack of wisdom behind launching a project like this, the team does seem to be trying to minimize their legal exposure, with token design that appears carefully crafted to take the project of the crosshairs of securities regulators, and various disclaimers trying to create an arms-length relationship between World Liberty Financial, the Trump family, and the Trump presidential campaign. The livestream kicked off with a long legal disclaimer to insist that those speaking were not providing financial advice and were not necessarily representing the views of the project, and at one point a project team member described lawyers in the room “staring daggers at [him]” as he spoke. Maxine Waters name-dropped the upcoming project in a hearing about defi in front of the House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion, citing the recent incident in which Twitter accounts belonging to Lara and Tiffany Trump were compromised and used to announce a fake token launch that resulted in a $1.8 million windfall for the hackers [I65, W3IGG]. This number is only going up, especially as the spoofed website and token promoted by the hackers still show up in the first page of Google results for “world liberty financial”, amid headlines in the New York Times and elsewhere.

During the hearing, on the other side of the aisle, Chairman French Hill (R-AR) argued that the crypto industry needs bespoke regulation, and bashed the Biden administration for “us[ing] rulemaking and enforcement actions to go after DeFi and threaten its existence and the future of its use in the United States.”19 Longtime crypto skeptic Brad Sherman (D-CA) commented that crypto was “an effort to liberate billionaires from income taxation”, continuing, “Every time a billionaire successfully cheats on his taxes, a member of the Freedom Caucus earns his wings.”20 The hearing featured five witnesses, four of whom were from the cryptocurrency industry.21

Crypto PACsThe crypto PACs just dropped another few million on Bernie Moreno’s Ohio Senate race against Sherrod Brown, bringing the total spending to support his campaign to over $27 million. This is more than twice as much as they’ve spent on any other candidate, including in the high-budget California Senate race where they spent $10 million to oppose candidate Katie Porter. This spending works out to around $800,000 a day.

Two Democratic Senate candidates have also received several million more apiece from the cryptocurrency PACs: Ruben Gallego in Arizona has received a total of $7.6 million in support, and Elissa Slotkin in Michigan has received a total of $6.9 million.

Republican Massachusetts Senate candidate John Deaton says he just can’t understand why Elizabeth Warren is so dang focused on crypto when there are other, more pressing issues to worry about.23 In case you forgot, John Deaton is an asbestos injury lawyer who jumped into the crypto world by filing amicus briefs in the SEC v. Ripple case, who moved to Massachusetts from Rhode Island to try to oust Warren because of her crypto stances, and who has received more than $2 million in crypto industry funding (amounting to about 60% of all his campaign funding).

Elsewhere in crypto

Tally Labs, the creator of a project that promised to let NFT holders create stories themed around their NFT characters, has announced they will be going in “a new direction”. The company once claimed to be run by a Bored Ape come to life, named “Jenkins the Valet”, who had an elaborate backstory and lore. Jenkins, however, seems to be going into retirement now, as the CEO wrote under his real name: “for tons of different factors, our NFT projects have lost escape velocity.” This announcement comes amid all-time low floor prices for Bored Apes, which have lost 93% of their dollar-denominated value (or 91% denominated in ETH) since their peak in April 2022.24

RIP Jenkins The Web3 is Going Just Great recapThere were eleven entries between September 6 and September 16, averaging 1 entry per day. $30.85 million was added to the grift counter. Flap to earn[link]

A blockchain-based version of the 2014 hit game Flappy Bird has emerged, taking advantage of the recent “tap-to-earn” crypto craze, itself driven by games like Hamster Kombat [I61, 62]. A new Flappy Bird Twitter account posted “I AM BACK!!” on September 12, with a video compilation showing people playing the original game. The tweet also claimed they were “working with [Flappy Bird's] predecessor”, leading many to believe that Flappy Bird creator Dong Nguyen was involved with the project.

Nguyen famously removed the game from app stores shortly after it surged to popularity, stating that he felt guilty that people were becoming addicted to the game. This makes the game’s reappearance — complete with loot boxes, microtransactions, and other addictive features — feel somewhat dark. On September 15, Nguyen returned from a seven-year Twitter hiatus to post: “No, I have no related with their game. I did not sell anything. I also don't support crypto.” Although Nguyen once held the Flappy Bird trademark, he did not sell it to this group. Instead, they registered the trademark themselves after arguing he had abandoned it. Zombie smart contracts[link] A rare CryptoPunk NFT recently sold for only 10 ETH (~$25,300), despite a market value that’s likely around 600 ETH (~$1.5 million). The sale went through thanks to lingering smart contracts from a defunct NFT fractionalization platform called Niftex, which allowed people to buy and sell “shards” of various NFTs. Niftex launched in November 2020, and is now defunct, with its domain redirecting to the Kraken cryptocurrency exchange.  CryptoPunk #2386 The platform’s smart contracts remain operational, however, and so despite the lack of a frontend website for the platform, the backend still remains. A trader was able to use these smart contracts to trigger a feature that allows a buyout of the fractional shard holders which, if not countered by someone else, automatically goes through in 14 days. The bidder proposed a purchase of 0.001 ETH per share, and without an operational Niftex frontend, basically no one noticed. The bid went through, and the trader successfully purchased all 10,000 shares — and thus, the NFT — for 10 ETH. Since then, several people have offered to purchase the NFT for amounts ranging from 100 to 605 ETH. If the new owner were to accept the 605 ETH bid, they would 60× their purchase price and make a profit of around $1.25 million. One owner of a fractionalized share said he thought he had managed to successfully block the sale, but miscalculated. “GG to the new owner”, he wrote. “I don’t consider this a heist. It’s an arb. The smart contract worked as intended. If you want decentralized systems you have to take the good with the bad. It’s part of the game. It’s why we’re here. If you don’t like those rules, you probably shouldn’t be playing.” Everything else- $6 million taken from Delta Prime defi protocol [link]

- Eve Online developer angers fans with announcement that their new game will be blockchain-based [link]

- eToro settles with SEC for $1.5 million, shuts down most crypto trading [link]

- Adam Neumann's Flowcarbon refunds customers after failing to launch “Goddess Nature Token” [link]

- Hacker steals $1.45 million from CUT token liquidity pool [link]

- Indodax crypto exchange apparently hacked for at least $22 million [link]

- State securities regulators settle with GS Partners over pyramid schemes including “tokenized skyscraper” [link]

- AssangeDAO accused of rug pull after transferring treasury to German foundation [link]

- Friend.tech team abandons project [link]

Worth a read

In the news

That's all for now, folks. Until next time, – Molly White

References

Brief for defendant-appellant filed on September 13, 2024. Document #28 in US v. Bankman-Fried (2nd Cir.). ↩ Bluesky post by Andrew Parker. “If the statute required ‘intent to cause loss’ every fraudster operating in investment fraud would claim that they didn’t intend to ‘cause a loss’ when they took money under false pretenses because their intent was to use the money to profit then return it.” ↩ Liteky v. United States, 510 U.S. 540 (1994) ↩ “Furious FTX judge threatens sanctions on former exec Ryan Salame for lying in guilty plea”, CNBC. ↩ Memorandum in support of motion filed on September 14, 2024. Document #70 in US v. Mashinsky. ↩ “Atomic Wallet wins dismissal of class suit over $100M hack”, Cointelegraph. ↩ In re Coinbase Glob. Sec. Litig. filed on September 5, 2024. ↩ “Florida Man Hit With 47 Years in Prison Over Violent Home Invasions to Steal Bitcoin”, Decrypt. ↩ “Bitcoin Miner Ionic Faces Challenge From Disgruntled Shareholders”, Decrypt. ↩ Memorandum opinion filed on September 12, 2024. Document #51 in KalshiEX v. CFTC. ↩ Emergency Motion for Stay Pending Appeal and Immediate Interim Relief filed on September 12, 2024. Document #1208661487 in KalshiEX v. CFTC (D.C. Cir.). ↩ Per curiam order filed on September 12, 2024. Document #01208661514 in KalshiEX v. CFTC. ↩ “A Failed Attempt at Market Manipulation”, Rajiv Sethi. ↩ “CFTC Issues Order Against Uniswap Labs for Offering Illegal Digital Asset Derivatives Trading”, U.S. Commodity Futures Trading Commission. ↩ “VC Giants a16z, Union Square Ventures Get Subpoenaed by New York About Uniswap: Sources”, CoinDesk. ↩ “The SEC has questions for VCs about Uniswap”, Axios. ↩ “Fed Issues Cease and Desist Order to United Texas Bank Over Crypto-Related Concerns”, Decrypt. ↩ “The Harris-Trump Debate Showed How Little Crypto Matters to Voters and Politicians”, CoinDesk. ↩ “Hill Delivers Remarks at Hearing to Break Down the Future of Decentralized Finance”, press release from the Financial Services Committee. ↩ “House lawmakers clash at first-ever DeFi hearing”, Blockworks. ↩ “Hearing Entitled: Decoding DeFi: Breaking Down the Future of Decentralized Finance”, Financial Services Committee. ↩ “Top Bernie Moreno aide, village councilman attacks police officers while second aide is arrested”, Scioto Valley Guardian. ↩ “Sen. Elizabeth Warren's Pro-Crypto Opponent, John Deaton, Has a Plan to Beat Her”, CoinDesk. ↩ “If You Bought Bored Ape NFTs at the Peak, You’ve Lost 93% of Your Investment”, Decrypt. ↩

I have disclosures for my work and writing pertaining to cryptocurrencies.

Thanks for paying for your subscription to this newsletter. You are the wind beneath my wings.

|