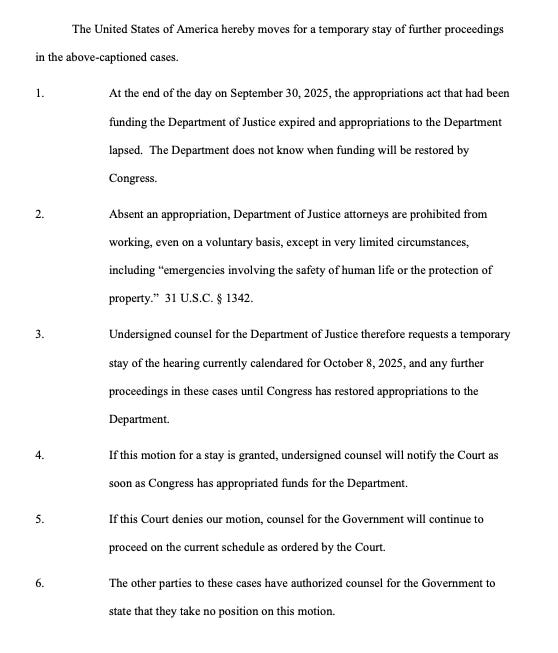

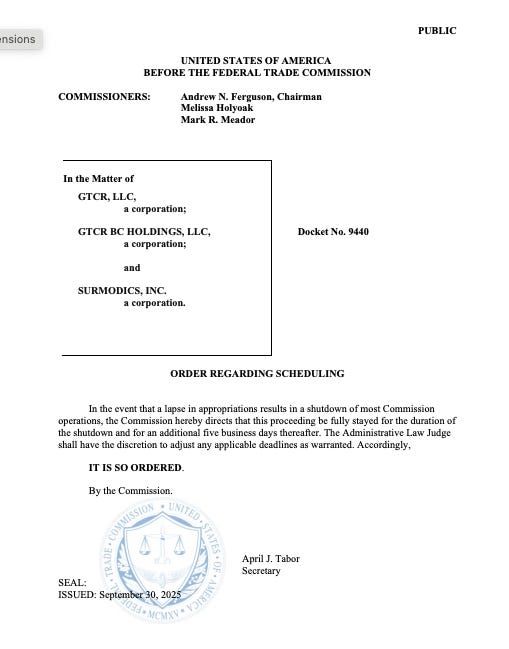

Wall Street Gets to Keep Its Government OpenThe Antitrust Division and FTC have suspended merger challenges, but not merger approvals. It's weird how 'government shutdowns' don't close the parts of government Wall Street wants.Over the course of the past week, and for as long as it goes, we’re going to hear “government shutdown” in the news, with disputes over who is at fault and various high-stakes negotiations. And that’s important, there will be harm and problems as a result. But I’ve always objected to calling these “shutdowns” when they are just partial closures; it’s not like air traffic controllers will stop working, or those who process imports are going to stop doing that. Saying these are government shutdowns teaches Americans the government isn’t necessary, since stuff seems to mostly work. But that’s only because the key parts of government aren’t shutting down. There’s another problem as well. The parts of the government going on furlough tend to do stuff for people without power, whereas the parts that remain operational either facilitate critical functions that keep society operating, or are important to the wealthy. The Federal Reserve, for instance, which manages a host of critical loans to Wall Street banks, is operating, because it isn’t subject to Congressional appropriations. It prints its own budget. But a similar apparatus for normal people who buy financial assets, aka homes, the National Flood Insurance Program, is shut down. Alas. I noticed this dynamic because the Antitrust Division just asked Judge Amit Mehta to suspend the Google search case’s final order until the government shutdown ends.¹ That’s a boon for Google, because it delays the actual implementation of any remedy, as well as any appeal. “Absent an appropriation,” write the legal team, “Department of Justice attorneys are prohibited from working, even on a voluntary basis, except in very limited circumstances, including ‘emergencies involving the safety of human life or the protection of property.’” The Antitrust Division is also seeking to delay other cases, like the monopolization charge against Visa. Similarly, the Federal Trade Commission is furloughing about half of the Bureau of Competition, and has suspended its one significant merger case against private equity firm GTCR over its acquisition of health care device maker Surmodics.² As the FTC notes in its administrative notice over the shutdown, “Employees responsible for law enforcement matters in litigation will, in cases where there is no imminent and significant threat to the safety of human life or the protection of property, notify opposing parties and the courts of the government shutdown and attempt to negotiate suspensions of dates for hearings and filings.” More broadly, the FTC is suspending investigations, and where litigation is already happening, seeking to “request suspensions of dates for trials, hearings and filings, or similar relief to preserve the government’s claim.” Basically, Wall Street now can merge without the police on the beat even paying attention. But one might argue, hey it’s a shutdown, what can you do? The problem is there’s is one antitrust function the FTC and Antitrust Division jointly run, and that they will keep open, which is their authority to approve mergers. Here’s the FTC’s memo on shutdowns describing the situation:

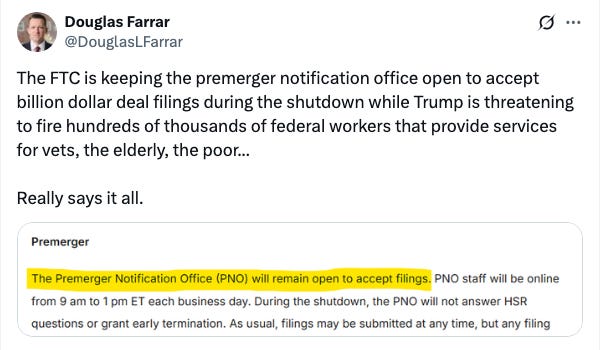

That seems problematic, since whether a merger goes through today or in two weeks is not “imminent and significant threat to the safety of human life or the protection of property,” unless the concern is a deal banker’s bonus. Here’s former FTC official Doug Farrar making the point: So it’s concierge service for Wall Street, with merger approval continuing but merger challenges suspended. And I’ll note there’s one other unusual thing going on. It’s not clear that the Antitrust Division even has to shut down. Technically, the Division is not funded by Congressional appropriations, it is funded by the fees that merging corporations pay to the government. Those merger filing fees go into a pot of money that pays for the enforcement cases. As the DOJ seems to explain in its shutdown memo, Pam Bondi could, if she wanted, simply keep the lights on with the money in the Division’s bank account. Here’s the relevant section.

That seems pretty clear. So why is the Antitrust Division suspending its case? The next sentence purports to explain.

Maybe there’s some legal aspect I don’t get here, but “for the sake of the FY 2026 contingency exercise” doesn’t sound like anything other than “find me a reason to suspend lawsuits against powerful companies.” Again, I could be wrong, appropriations is a very tricky area of law, especially when it comes to the weird way we fund antitrust. But I don’t get why the DOJ has to process pre-approvals of mergers, while suspending other activities. I don’t think this dynamic is unique to antitrust, but government “shutdowns” tend not to shut down the things that people with a lot of money care about. If they did, they probably wouldn’t happen. Thanks for reading! Your tips make this newsletter what it is, so please send me tips on weird monopolies, stories I’ve missed, or other thoughts. And if you liked this issue of BIG, you can sign up here for more issues, a newsletter on how to restore fair commerce, innovation, and democracy. Consider becoming a paying subscriber to support this work, or if you are a paying subscriber, giving a gift subscription to a friend, colleague, or family member. If you really liked it, read my book, Goliath: The 100-Year War Between Monopoly Power and Democracy. cheers, Matt Stoller This is a free post of BIG by Matt Stoller. If you liked it, please sign up to support this newsletter so I can do in-depth writing that holds power to account. |