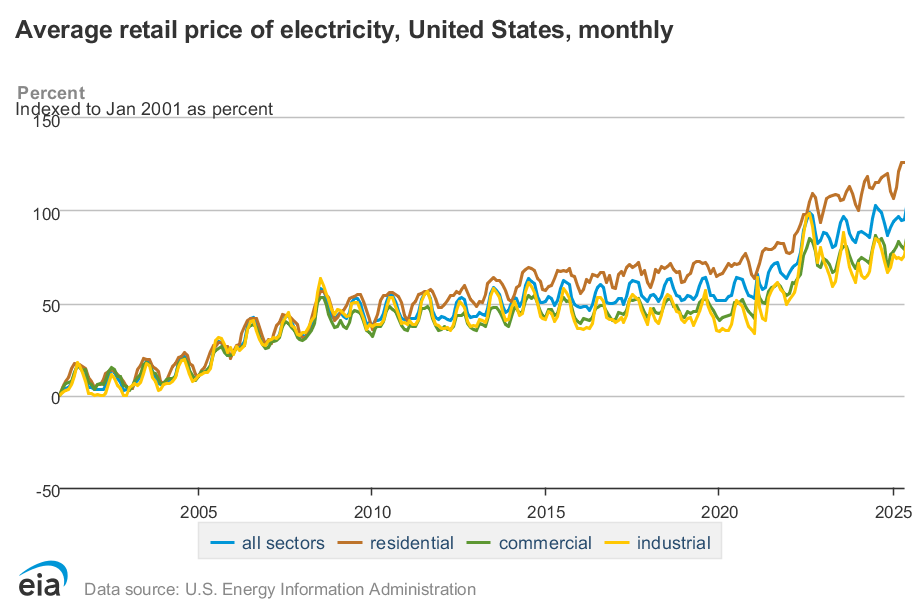

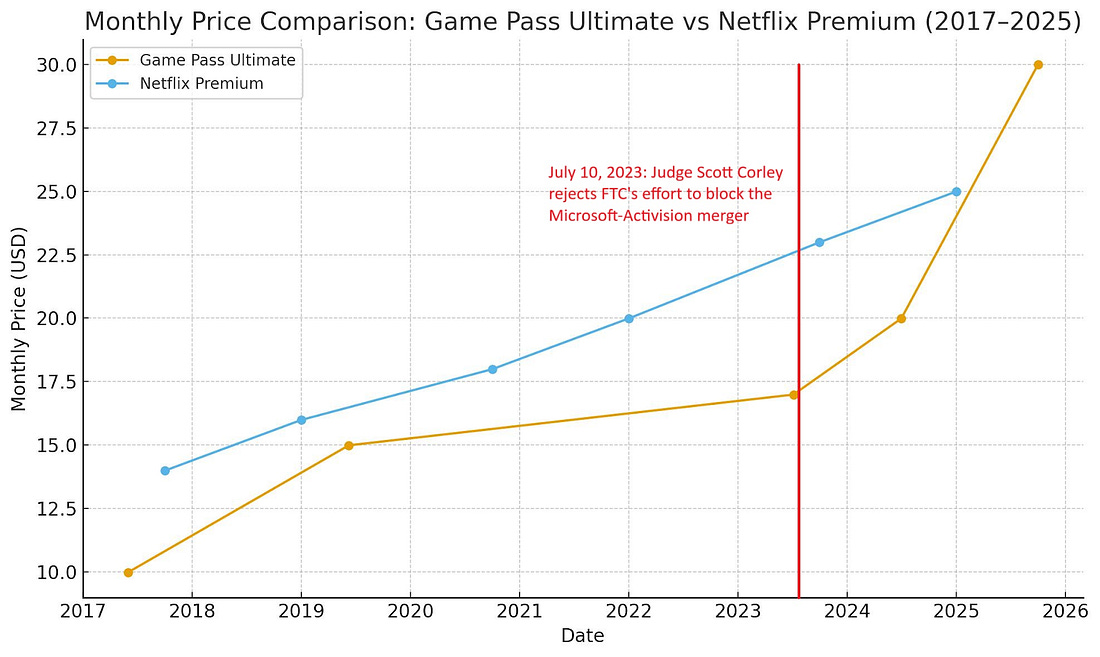

Welcome to You’re Probably Getting Screwed, a weekly newsletter and video series from J.D. Scholten and Justin Stofferahn about the Second Gilded Age and the ways economic concentration is putting politics and profits over working people. Private Equity and your Utility BillFinanciers, high prices, and the need for regulators to step up.Welcome to You’re Probably Getting Screwed, a weekly newsletter and video series from J.D. Scholten and Justin Stofferahn about the Second Gilded Age and the ways economic concentration is putting politics and profits over working people. On Friday private equity notched an important victory in Minnesota that could have significant ramifications for control of our energy infrastructure and the size of your utility bill. It is also a key example of the many levers that can exist for halting the march of concentrated corporate power, if we use them. Last week the Minnesota Public Utilities Commission (PUC), the body charged with regulating the state’s monopoly utilities, unanimously approved the acquisition of ALLETE by Global Infrastructure Partners (GIP) and the Canadian Pension Plan Investment Board (CPP). ALLETE is an electric services company based in Duluth that owns Minnesota Power, a utility serving the northeast portion of the state. GIP is a private equity firm that was recently acquired by BlackRock, the world’s largest asset manager with over $11.5 trillion under management.  The PUC’s approval came despite the strong recommendation from Administrative Law Judge Megan J. McKenzie that commissioners reject the deal. “The nonpublic evidence reveals [GIP and CPP’s] intent to do what private equity is expected to do – pursue profit in excess of public markets through company control.” The deal will make Minnesota Power the state’s only investor-owned utility to be taken private, which is a move that often results in job cuts and limits transparency. A study in 2021 found that private equity takeovers of publicly-traded companies resulted in a 13% reduction in jobs in the two years following the acquisition. Beyond job cuts, recent history would also suggest rate increases are around the corner. In 2014 the Michigan Public Service Commission approved the sale of the Upper Peninsula Power Company (UPPCO) to a private equity firm, which then sold it to another private equity firm just seven years later. Under its private equity owners, UPPCO has received approval for four rate hikes and now charges $9 more per kilowatt hour than the state’s other utilities. For context, the average rate in Michigan as of July was $20.56 per kwh. If you want more details on this deal specifically I would check out the More Perfect Union video above, this piece in The American Prospect, this piece in Truthout and the work of the Citizens Utility Board of Minnesota, CURE, Private Equity Stakeholder Project and the Energy and Policy Institute. But I want to zoom out from this particular acquisition and look at some broader implications. This is not BlackRock’s last foray into our energy infrastructure. The firm’s billionaire founder and CEO Larry Fink has said BlackRock is at the start of a “golden age” of investment in infrastructure. As the PUC was approving GIP’s takeover of Minnesota Power, news broke the company also intends to acquire AES, one of the world’s largest power companies. GIP is also seeking to acquire Aligned Data Centers, which operates over 80 data centers around the country. This is not just BlackRock/GIP either, as private equity firm Blackstone is seeking regulatory approval to buy out Public Service Company of New Mexico and Texas-New Mexico Power. At the heart of these moves is the race to get a piece of the expanding artificial intelligence (AI) bubble. MacroStrategy Partnership told clients the AI bubble is 17 times the size of the dot-come bubble and four times bigger than the Great Recession real-estate bubble. Financial Times (paywall) reported in an article titled “America is now one big bet on AI” that over 40% of US GDP growth this year is from AI along with 80% of stock market gains. Among the S&P 500, just 10 companies are driving positive growth and those 10 are primarily tech companies gorging on AI. That AI bubble also means higher prices for consumers. However, it should be noted that the average retail price of residential electricity in the United States has increased 126 percent since 2001, well before the AI boom. The problem is not just AI, but the timidity of state utility regulators that have allowed utility monopolies to continually boost their profit margins. Yet, Bloomberg recently reported that wholesale electricity costs have gone up as much as 267% over the past five years in communities near data centers. According to the Union for Concerned Scientists, consumers in Illinois, Maryland, New Jersey, Ohio, Pennsylvania, Virginia and West Virginia are paying $4.3 billion for transmission upgrades solely to serve data centers. This was all before OpenAI announced a plan with Nvidia to build a set of data centers that will consume as much energy as New York City and San Diego combined! So of course private equity wants a cut while things are hot, and Minnesota has now given them the playbook. And for what exactly? As I wrote about several weeks ago, the AI Utopia that Big Tech is promising is a nightmare of copyright infringement, surveillance capitalism, social media slop, and anticompetitive business practices. Northern Minnesota is now faced with the prospect of paying higher utility bills so that a company can use AI to raise your rent, airfare or food costs. An endless cycle of higher prices that enriches Wall Street and screws the rest of us. The other part of this story worth noting is the hurdles BlackRock had to clear in this process and what it says about the need for more populist economic thinking across the halls of power. BlackRock’s acquisition of GIP last year had to receive approval from the Federal Energy Regulatory Commission (FERC), the same body that approved an extension of BlackRock’s blanket authorization to acquire voting shares in utilities despite the chair voicing concerns about BlackRock’s size and power. After acquiring GIP, the Wisconsin Public Service Commission approved GIP’s acquisition of ALLETE, which also owns Superior Water, Light and Power. Not only did GIP get the blessing of the Minnesota PUC to complete its acquisition, but the Minnesota Department of Commerce - which initially opposed the deal - supported it after receiving minimal concessions like a one-year rate freeze. A variety of regulatory bodies had a chance to put a stop to private equity’s utility power grab and failed to do so. I really hope this time is different and all the benefits ALLETE and BlackRock have promised come true. Yet what in recent history would suggest that? YOU’RE PROBABLY (ALSO) GETTING SCREWED BY:Microsoft Speaking of that Microsoft Activision merger, despite Microsoft claiming in court that the merger would not result in higher Game Pass prices, those costs have skyrocketed. New Economic Terms: Boomcession Bankification

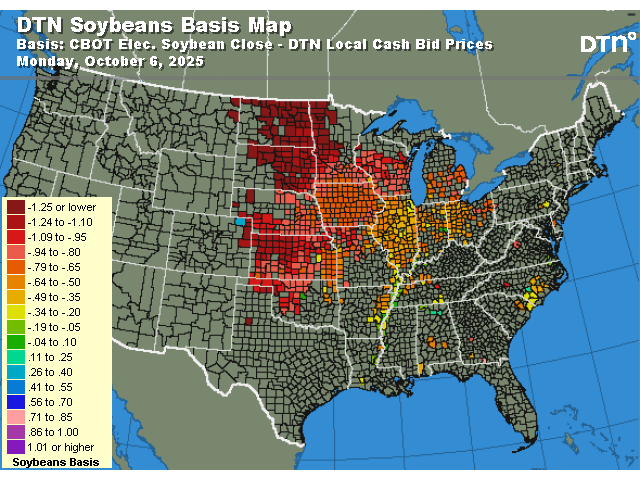

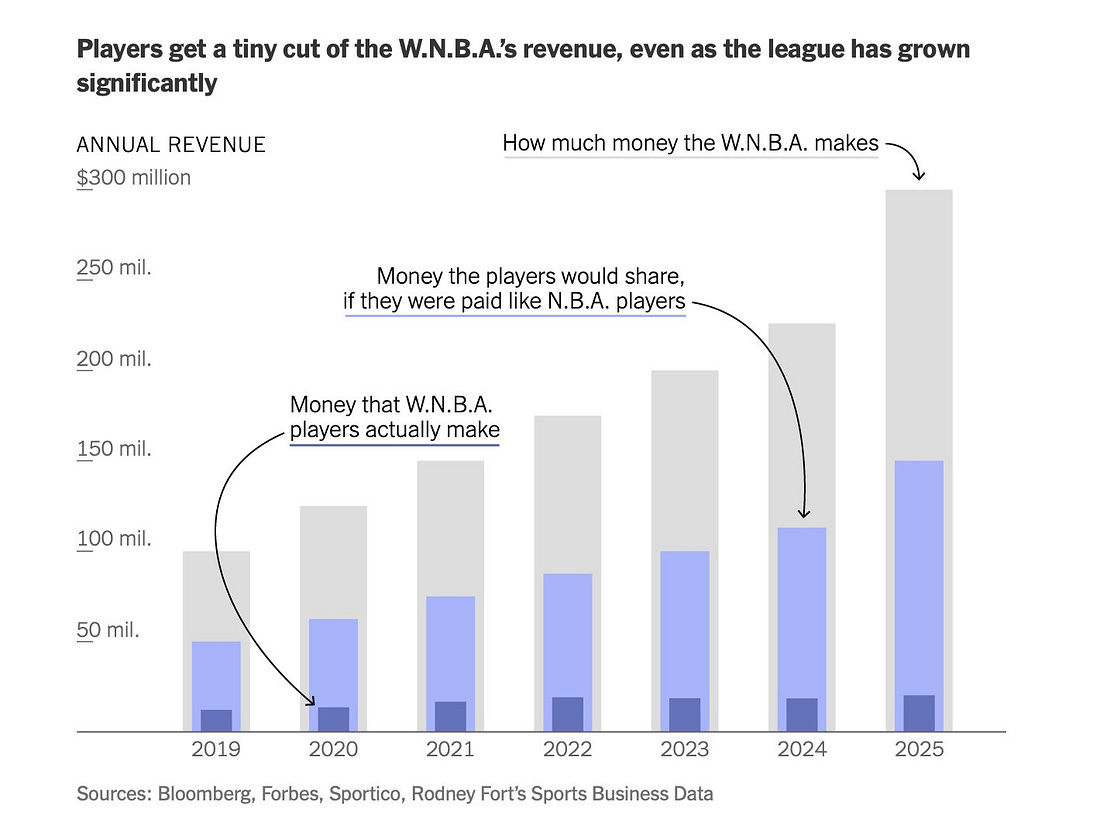

Grain Storage President Trump’s $20 billion bailout of the far-right government of Argentina - a main US competitor in the soybean market - allowed Argentina to remove its own export taxes on soybeans. In addition to further undercutting American farmers already hurt by Trump’s trade war, the bailout will also primarily benefit one GOP billionaire that is good friends with US Treasury Secretary Scott Bessent. This is all happening while a new report provides further evidence of the challenging picture for farmers and grain elevators. “The U.S. is estimated to be short 73 million bushels of upright grain storage this year versus last year’s surplus of 1.8 billion bushels of capacity,” according to the new report from CoBank. The map below shows the bleak pricing farmers throughout the Midwest are facing. U.S. Soybean Market Speaking of soybeans and the Argentina bailout, Breaking Points has a recent segment about the growing rage of farmers that also features a video JD put together on the issue.  WNBA Salaries The WNBA has been seeing explosive growth in recent years, but players have not been reaping the benefits. As the WNBA and its players union enter a critical negotiations over a new collective bargaining agreement this fall David Berri took a look at the vast different in revenue sharing between the NBA and WNBA. Food Wasted Airline Industry The CEOs of Frontier and Allegiant Airlines testified before a Senate Judiciary Subcommittee on the state of competition in the airline industry. Bill McGee of the American Economic Liberties Project testified about the systemic problems plaguing the industry. “When times are good, [big airlines] make money and they keep it and they use it for stock buybacks and executive compensation. When times are bad, they come right here and ask us taxpayers to bail them out.”  SOME GOOD NEWSAlgorithmic Price Fixing Great News!!!! Yesterday, California Governor Gavin Newsom signed new legislation, AB 325, to ban algorithmic price fixing. The new law prohibits corporations from using algorithms and digital tools to manipulate the prices on essentials such as rent and groceries. Advocates of the law called AB 325 “groundbreaking” and said it’s a “critical step in addressing California’s affordability crisis by cracking down on tech-enabled price manipulation.” Thank you to TechEquity, Economic Security California Action (ESCA), and American Economic Liberties Project (AELP) for their work on the legislation! New Substack! Ron Knox of the Institute for Local Self Reliance has a new substack “Who Shall Rule” that you should check out! BEFORE YOU GOBefore you go, I need two things from you: 1) if you like something, please share it on social media or the next time you have coffee with a friend. 2) Ideas, if you have any ideas for future newsletter content please comment below. Thank you. Break ‘Em Up, Justin Stofferahn |