| Read in browser | ||||||||||||||

Good afternoon from Los Angeles, home of the back-to-back World Series champions. I just got back from Ojai, where we ate well, hiked and checked out a very cute movie theater with some dangerous frozen palomas. I will be in Stockholm and New York later this month, reach out if we should meet up. We’re going to talk through some scoops on the movie business, a savvy David Zaslav move and two huge podcast deals. If you’ve got any story ideas, try me at lshaw31@bloomberg.net. Five things you need to know

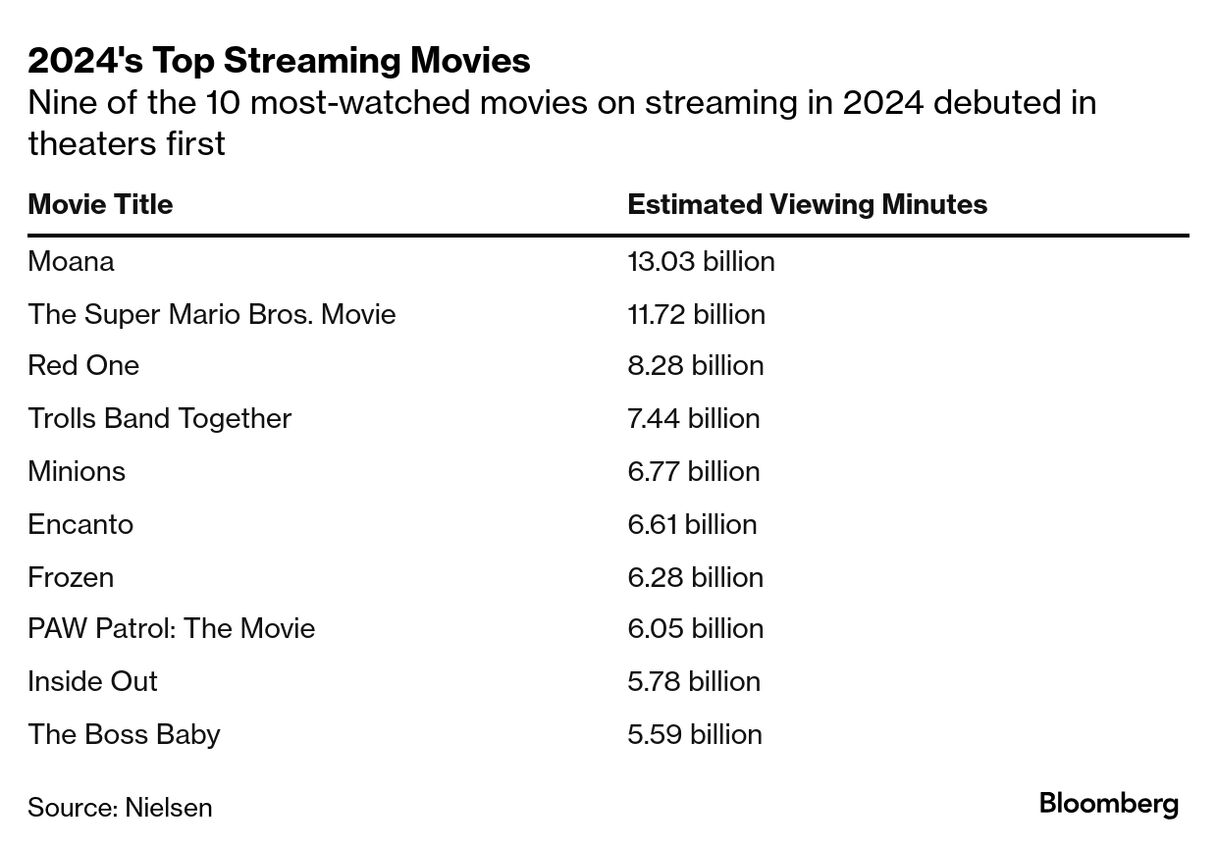

Box-office duds become streaming hitsWhen Madame Web debuted on Netflix last year, it proved quite popular with the streaming service’s customers. Despite being a box-office bomb, Madame Web was the No. 1 movie on all of streaming during its first week. It scored a bigger opening than box-office hits like Anyone But You and It Ends With Us. This has happened a few times of late — films that failed in theaters did well online. That has prompted Sony to study whether its fees should be based at least in part on how a movie performs online. Currently, Netflix pays a fee per film based on domestic box-office performance. But since ticket sales aren’t always the best predictor, the studio has discussed asking its next partner to share how many users start a film or finish it. It’s also looking for some protection if movie ticket sales decline more in the future.  It’s possible this comes to nothing. Many of Sony’s peers — and even some of the people at Sony looking into this idea — are skeptical. Box-office sales are still the simplest metric. Yet Sony’s exploration of a new model shows studios are rethinking how they value movies. Both Sony and Paramount are shopping the rights to their movies after they leave theaters. Netflix, Amazon, Hulu and HBO Max have all expressed interest and would pay the companies hundreds of millions of dollars a year. (No studios have gotten Apple to bite on these deals.) Streaming has changed the way these studios handle their films. Studios have historically sold the rights to one partner, like HBO, for 18 months. They would license later rights to cable networks such as FX, TNT and TBS. Networks paid a lot of money for these movies because the biggest blockbusters generate a lot of viewership. Streaming services began paying an even higher price, all but boxing out HBO. Nine of the 10 most-watched movies on streaming last year were initially released in theaters.  But studios have started to split the rights to boost their own streaming services and maximize revenue. Consider Universal, which has a new deal with Netflix. In the future, the studio will put its movies on its own Peacock service first before they appear on Netflix and then ultimately return them to Peacock. This will allow Universal parent Comcast to boost its third-tier streaming service with hit movies, generate money from Netflix and expose its pictures to more people on a more popular platform. Warner Bros. has also modified this practice, putting its movies on HBO Max first and then licensing them individually to Netflix and Amazon. Paramount Skydance chief David Ellison hasn’t decided on his partners, in part because he’s busy trying to buy Warner Bros. Discovery. But he knows the rough contours of his next deal. Paramount is going to mimic Universal, putting its films on Paramount+ for a few months before selling them elsewhere. Ellison wants to prop up Paramount+ but can’t afford to keep his movies on that service for too long. Amazon, HBO Max and Hulu are the leading contenders for that second window. Sony doesn’t have a streaming service to worry about. Netflix pays the studio hundreds of millions of dollars a year for movies after they leave theaters. That deal has worked out well for both sides. Sony gets paid a lot of money, and Netflix gets a steady stream of popular titles. Netflix would like to renew with Sony and extend the deal – taking global rights. Securing movies from both Universal and Sony would give Netflix a steady stream of hit films for years to come. Even if Sony doesn’t radically change the economics of the deal, it’s already reinvented the pay-TV deal somewhat: Netflix also committed to buy Sony projects that are only released online, like KPop Demon Hunters. The best of Screentime (and other stuff)

Is David Zaslav winning the war?David Zaslav addressed the full staff of Warner Bros. Discovery for the first time since putting the company up for sale. He said the board wants more money! The company has already rebuffed three offers from Paramount Skydance, the last at about $23.50 a share. Zaslav is doing his best to ignite a bidding war and/or keep his job. If someone offers enough money, the board will have to take it (or at least entertain the idea). And if no one does, Zaslav can proceed with his plan to spin off cable networks. It remains unclear just how interested Comcast, Netflix and Amazon are. They are all going to look at Warner Bros. but don’t want the whole thing. Nor are they guaranteed to make an offer. Zaslav, Netflix co-CEO Ted Sarandos and Paramount’s Ellison all attended a gala in Los Angeles this past week where Zaslav was being honored. Zaslav thanked Sarandos, his friend, and made no mention of Ellison. Paramount’s aggressive approach has forced Warner Bros. to put itself up for sale, yet Zaslav’s maneuvers in response have been a win for shareholders. It’s been six weeks since the first reports of Ellison’s interest in buying Warner Bros. Shares of Warner Bros. are up almost 80%. Paramount has barely budged. Even if Paramount wins — it’s still the favorite — the company will need to increase its offer. Two huge podcast dealsAshley Flowers, host of the hit podcast Crime Junkie, is moving her business from SiriusXM to Fox Corp.’s Tubi as part of a $150 million deal. For all the fuss about Netflix getting into business with podcasters and online content creators, it’s actually Fox that has been the most aggressive. It acquired Red Seat Ventures, which provides services to several top podcasters, and struck a partnership with Barstool Sports. Tubi has been commissioning lots of programming from creators, and Crime Junkie is a big bet. It is one of the five most popular podcasts in the US. Flowers’ move to Tubi is yet another example of the growing importance of video to podcasters, as Ashley Carman explained in her newsletter. Steven Bartlett, host of the Diary of a CEO podcast, raised money at a valuation of $425 million, an astounding sum of money for a show of his size. (He also operates a software business.) Bartlett’s remarks on the deal raised a red flag. He said he was looking forward to building the next Disney. People in media love to toss around that phrase and it’s almost always nonsense. The No. 1 movie in the world is…Regretting You, I guess. This was a terrible weekend for moviegoing. The aforementioned adaptation a Colleen Hoover novel grossed about $8 million domestically and a similar number abroad. That narrowly edged Black Phone 2 in its third weekend. This was the second-worst weekend for moviegoing in the US and Canada this year, trailing only the middle of March. Deals, deals, deals

Weekly playlistWe spent the entire drive to and from Ojai alternating between two albums: Lily Allen’s West End Girl and Geese’s Getting Killed. More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|