| Read in browser | ||||||||||||||

Good afternoon from Los Angeles. I am going to start by dropping a little news about one of my favorite bands. The Red Hot Chili Peppers are finalizing an agreement to sell their recorded music catalog to Warner Music Group in a deal that values the masters at $300 million to $325 million. This was supposed to be done months ago. Billboard first reported the band was shopping the masters in February, and the Financial Times said Warner was in talks to buy it back in July. The Chilis have been releasing music at Warner Records (formerly Warner Bros. Records) since 1991’s Blood Sugar Sex Magik, a breakthrough album for a quartet of punky Angelenos. Other parties have tried to get in on the talks, promising more than Warner — one entity floated as much as $375 million. Yet the band, advised by lawyer Eric Greenspan and manager Guy Oseary, hasn’t let anyone else see the books. This deal could still fall apart and may not close for another couple months. The negotiations have moved at a glacial pace, and nothing involving this genre-busting rock band is ever easy. For anyone who missed it, I wrote a piece for the latest Businessweek about Netflix’s quest to turn KPop Demon Hunters into its first global franchise. It included the news that the sequel to the film is tentatively slated for 2029. Five things you need to know

Netflix is getting serious about podcastsNetflix is looking to commission original video podcasts, and plans to tweak its product to ensure the shows get better promotion in its app, according to several people familiar with the company’s plans. It’s the clearest sign yet that the streaming service is getting serious about podcasts as a new form of programming. The company has reached out to talent (and their representatives) about making original shows that would be exclusive to the service. The streaming service is also looking to license existing shows from networks. This mirrors Netflix’s approach to TV and film programming: It licenses extant hits and funds original exclusives. Netflix will launch a marketing campaign to support the podcasts and make adjustments to its app to ensure users know about them, said the people, who asked not to be identified because the plans are still being developed. The company is also going to adjust the user interface for its mobile app next year, including the addition of vertical videos, changes that aren’t specific to podcasts. These initiatives, some of which haven’t previously been reported, underscore Netflix’s growing investment in podcasting. Netflix has funded podcasts that help market its shows and movies for some time, but co-CEO Ted Sarandos first expressed interest in podcasts as a programming category akin to live sports or sitcoms earlier this year. Sarandos teased Netflix’s interest in podcasts before his content team had a fully developed plan. His deputies had previously talked about licensing the exclusive rights to popular shows like Alex Cooper’s Call Her Daddy, but couldn’t justify the cost. SiriusXM paid Cooper more than $100 million for distribution and advertising rights, and the show isn’t even exclusive to its subscribers. Netflix has since refined its strategy, signing deals with major networks, such as Spotify, paying for the exclusive full-length video rights to dozens of shows and allowing the audio and clips to be widely distributed. It’s in talks with iHeartMedia, as well as Sirius. This is a low-cost experiment. Netflix is signing one-year deals, many worth less than $10 million, as my colleague Ashley Carman has reported. It gets to see how users engage with video podcasts and whether this could be a new genre for the company. It also gets to keep some shows off of rival YouTube. Despite constant murmurs, Netflix hasn’t hired an executive to oversee podcasting. It has put two teams in charge: content licensing, which falls under Lauren Smith, and the unscripted/live group led by Brandon Riegg. The content licensing group has been looking to hire an executive who would, among other things, work on podcasting. These deals aren’t yet huge moneymakers for podcast networks. But Spotify, iHeart and Sirius are all hoping Netflix will expose their shows to new viewers, which will make them more valuable in a year or two. (iHeart is a strategic partner of Bloomberg Media.) The worst-case outcome for this experiment would be Netflix’s experiments in interactive shows or fitness videos. The streaming service struck a deal with Nike a few years ago to license fitness videos. But few people watched them, and Netflix wound down the program. Executives at Netflix learned a couple lessons from that failure that they are applying to podcasts. They concluded they hadn’t licensed enough videos for users to know or care that it had fitness. That’s one reason Netflix is seeking a high volume of podcasts. The fitness videos also had only a small but passionate audience, which limited their reach. Netflix has long allowed its algorithm to determine the success and failure of a show. Given the small base for fitness content, the algorithm wasn’t recommending those videos to enough new viewers. With podcasts, Netflix wants to make sure they get noticed. The potential audience for these shows is going to be small in Netflix terms. Most get hundreds of thousands of listeners per episode — and that’s on platforms where people actually listen to podcasts. Netflix will start from scratch. Netflix’s algorithm buries titles that attract a small audience, deeming them unpopular. So the streaming service has to find a way to give podcasts a chance to reach viewers. It wants the video podcasts to feel distinct and stand out within its app. Podcasts debut every week, which is a different cadence than most Netflix shows, which drop all at once. This challenge isn’t unique. Other Netflix shows, like WWE’s Raw and the upcoming Star Search, also debut weekly. Netflix could wake up in a couple of years and decide podcasts aren’t worth the effort. But after months of talking down the category, executives at the company are finally acknowledging they are serious. For those who don’t know, I appear on a Spotify podcast every week. We don’t yet produce in video, and I don’t think Netflix has any interest in my face. The best of Screentime (and other stuff)

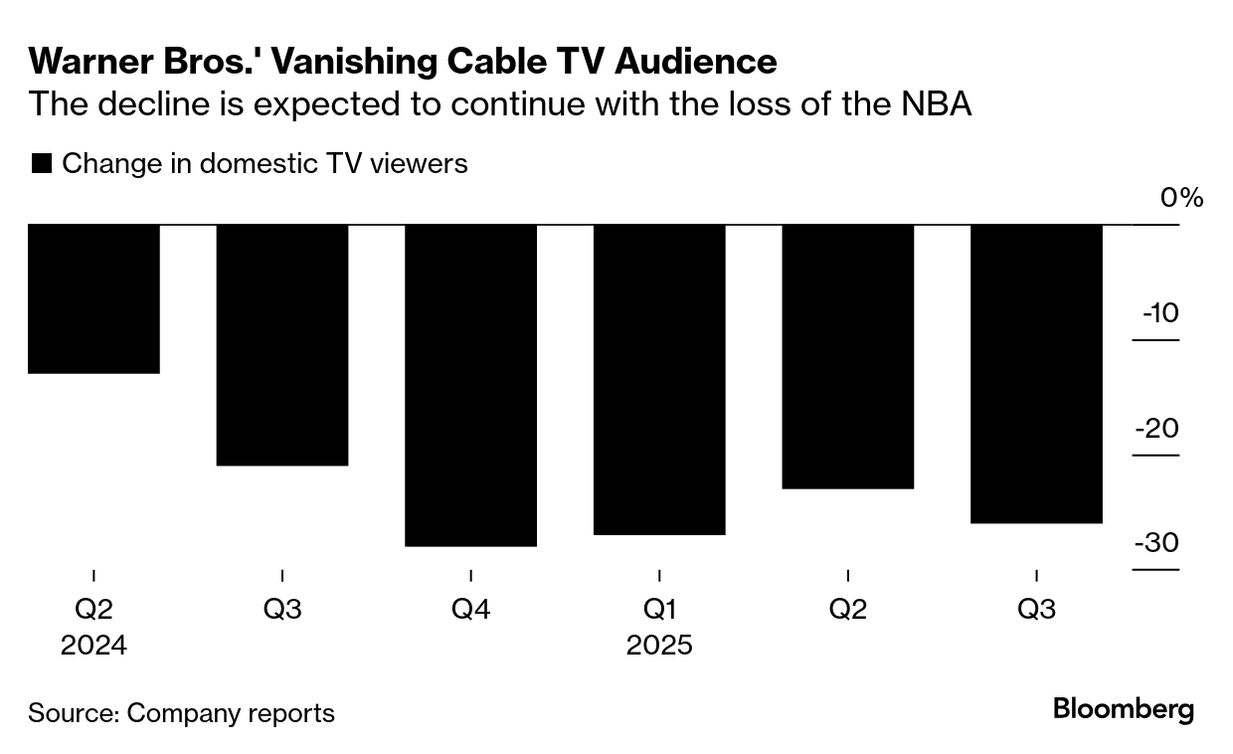

Baseball is back, baby!Major League Baseball just wrapped the most-watched World Series in eight years. An average of 15.7 million people in the US watched the Los Angeles Dodgers defeat the Toronto Blue Jays over seven games. The audience was even bigger abroad. The series averaged 34 million viewers if you include Canada and Japan, which baseball says was its largest audience for a World Series since 1992. Ignore all the nonsense about the Dodgers ruining baseball. The combination of rule changes that expedited the game, compelling matchups and a pseudo-dynasty has restored interest in a sport that had been flagging. The Dodgers’ investment in Japanese talent has proven especially beneficial for the league. Now, true to form, baseball will likely shut down due to labor strife and waste this moment. Warner Bros. has a TV problemWarner Bros. Discovery shrank again. It reported third-quarter sales of $9 billion, down 6% from a year ago. That was despite a 24% jump in revenue at its studios division. The reason for the decline is pretty obvious. Warner’s TV networks reported a 22% drop in sales. You wanna see an ugly chart? Look at the audience declines at the company’s linear TV networks:  Spotify’s good isn’t good enoughSpotify beat investor expectations for growth, and its shares fell anyway. The Swedish streaming giant suffers from the same enviable problem as Netflix. It is a clear market leader whose shares trade at a price that defies normal valuation. That is good nine times out of 10. But that also means that when earnings are good not great, investors get punished. While Spotify is adding tens of millions of users a year, its advertising business is still a mess. Deals, deals, deals

Weekly playlistKendrick Lamar earned the most Grammy nominations of any artist, followed by Lady Gaga, Bad Bunny and Sabrina Carpenter. It’s too bad that two of my favorite recent albums won’t be eligible until the 2027 Grammys. I’ve talked about Lily Allen enough. The new Rosalía might be even better. Good lord, what a gorgeous album. More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|