| Read in browser | ||||||||||||||

In the spirit of Thanksgiving, thank you to the bankers and lawyers involved in the Warner Bros. Discovery auction for not ruining our holiday with leaks. I fear they spent a lot of it working, however. Warner Bros. asked for fresh bids by Monday, hoping the three suitors would increase their offers and clarify any concerns. Warner Bros. is expected to pick a favorite bidder and enter exclusive talks soon, though the company told the contenders this isn’t a deadline for a last-and-final offer. Every side is trying to claim a leg up when it comes to getting the deal approved. Paramount is still seen as the most likely buyer and confident of its leadership’s close relationship with the White House. Yet rivals suggest the company is too confident and ignoring an inevitable effort to block the deal at the state level. Netflix has emerged as a credible bidder, but some officials and rivals insist there is no way governments here or abroad will allow the market leader in streaming to consolidate even more control. Netflix’s size depends on how you define the market. Are we including YouTube or only Hollywood services? Comcast has drawn less attention than either of those, perhaps because it has the least cash to offer. But it remains a preferred option for Warner Bros. CEO David Zaslav. Five things you need to know

The hunt for good news in HollywoodThe success of Wicked: For Good and Zootopia 2 has quieted the resurgent pessimism about the movie business. Wicked: For Good will eclipse $400 million worldwide imminently while Zootopia 2 is on track to be one of the biggest hits of the year. And yet, US ticket sales the last two weekends have declined from a year ago. Wicked: For Good and Zootopia 2 were less potent than the trio of Gladiator 2, Wicked and Moana 2. How you interpret that data depends on your perspective. You can get excited that people still show up for select movies. Or fret that moviegoing is locked in a doom spiral. People who work in media and entertainment are looking for reasons to be hopeful. “Not everything is failing, what are the things that are working?,” one reader asked. Some are fixated on ways the entertainment business can grow — like gaming and podcasting — while others want to restore the glory of what was. I don’t have all the answers. But with just one month left in the year, and a jumbo slate of newsletters for you in December, I wanted to answer readers’ questions about the state of the entertainment business. Fixing the moviesWhat would it look like for the movies to go back to being mass entertainment? How do you make it cheaper and less event driven? If we could go back, should we? A debate that has raged for many years. If you make it cheaper to go to the movies, would it become mass entertainment again? Theater owners don’t think so. People can watch endless amounts of great material for free. You would be lowering the price to increase total attendance. That has worked well on certain days discount days, but not as a permanent strategy. Movies differentiate themselves in two ways: The experience at the theater (comfy loungers, big screens) and the superior production quality on screen. Both of those suggest moviegoing will get more expensive, not less. How much of what the film industry is going through can also be attributed to marketing? Blaming the marketing is the oldest trick in the book. Studio chiefs always like to fire their marketing chiefs when films fail. Marketing a movie is as hard as it’s ever been, given the paucity of ways in which to reach a mass audience. There are both more ways to reach people and fewer ways to reach everyone. Yet for all the hand-wringing about the recent failures of several movies, ask yourself one question. What movie released this fall should have been a much bigger hit than it was? No one has given a good answer. The closest was a friend who said The Smashing Machine should have opened to $9 million instead of $6 million. That still would have been a disappointment. Will California tax credits reignite work in Hollywood? Local movie and TV production fell 14% last year, according to a report from FilmLA. That follows a 20% drop the year before. The decline is due largely to a global drop in production. Los Angeles’ share of production didn’t actually fall all that much in 2024. Film and TV production isn’t going to skyrocket in the next couple years. Studios aren’t increasing their budgets. If anything, further consolidation portends less production. So the question is whether California can win more share from other states and countries. It’s too soon to know. The tax credits are brand new. The state has touted a few big projects that relocated, but that doesn’t mean anything. The next big trends in storytellingAre video games the next intellectual property gold rush in Hollywood? Hollywood studios are taken with any intellectual property that feels reliable. Gaming has proven to be a lucrative category, so, yes, there will be a lot more adaptations. There already are. A video game adaptation has ranked among the 10 highest-grossing movies for three years running. But it’s not just gaming. Expect lots of adaptations of romantasy books and more from Colleen Hoover. Heck, UTA just signed Parmigiano Reggiano Consortium as a client. Paramount is looking at every piece of major IP it has, from Star Trek to G.I. Joe. Here’s a nugget: Paramount is in the process of buying up many of the rights to the Tom Clancy estate that it doesn’t already have. It produces the Jack Ryan TV show. But you aren’t seeing film and TV studios bet as much on new. Even Netflix, Apple and Amazon are more interested in franchises than they once were. Two non-Hollywood films are likely to top $1 billion in 2025 (Ne Zha 2 and Demon Slayer): fluke or harbinger? Ne Zha 2 is the Chinese blockbuster that has grossed $1.9 billion. It could top Avatar as the highest-grossing movie of the year. The latest Demon Slayer is at $730 million, so it likely won’t hit $1 billion. But the Japanese animated film is still going to be one of the 10 biggest movies of the year. It’s hard to see this as a fluke. China has churned out big local hits for several years now. The big question is whether any other country, like Japan or India, can consistently produce global hits. Do you think other streamers will follow Netflix’s lead and start incorporating gaming into their platforms? Disney seems to be teasing it with their Epic partnership. Streaming services are interested in adding any programming that will make you spend more time within their walls — engagement, in industry jargon. They have been focused on clips and TikTok-like features, video podcasts and, yes, games. But we’re not talking high-end, immersive games. Peacock has word games and puzzles. Netflix just introduced Boggle. Because cloud gaming has yet to take off at scale — and because integrating big games into these streaming services is technically challenging — they’re starting with smaller games either good for an individual on mobile devices or a group on a TV. Netflix’s investment in gaming thus far hasn’t been very successful — the company’s co-CEO gave them a B-minus — and no other streaming service has made a comparable push in that direction. Disney teased “game-like” features, but that doesn’t sound like Fortnite within Disney+. A lot of legacy companies are trying to develop a podcast strategy. Are they looking to build internally or acquire shows? Both. Consider Fox, which handles distribution and advertising for a lot of popular programs through Red Seat Ventures and will feature creator-led shows on Tubi. Or Netflix, which will offer the video version of existing hit shows and is also looking to develop programs internally. (Netflix has approached comedian Leanne Morgan about hosting a podcast, for example.) These are tiny investments for any of these companies. The next wave of dealmakingGiven Disney’s strength in media, theme parks and consumer products, do you see an opportunity for the company to expand Disney+ into an all-inclusive fan loyalty program? Former CEO Bob Chapek explored a version of this strategy. Bob Iger hasn’t provided a major update. But there are compelling propositions that Disney could offer people who buy the annual pass to its parks: free movie tickets and streaming. Or it could give subscribers to its streaming service a discount at parks. Disney is the rare entertainment company with a loyal following. The Paramount and Warner Bros. names mean almost nothing to the average consumer. Is Lionsgate now effectively the ‘MGM of 2025’ — the studio that suddenly becomes more valuable because everything bigger has regulatory baggage? And is Starz really going to buy A&E? Former Treasury Secretary Steve Mnuchin and billionaire Steve Cohen both seem to believe someone is going to buy Lionsgate. They have been buying the stock. (If you have some insight into this, email me!) Lionsgate has been for sale for years more or less and has never found an option as good as the bid it ultimately rejected from Hasbro. Its talks with Legendary, the studio behind Dune, haven’t yielded a deal. The biggest media companies are all focused on Warner Bros. Discovery at the moment. If Netflix or Paramount fails to buy Warner Bros., could they turn to Lionsgate? They could. But they also could have acquired it many other times over the last few years. As for A+E, it seems as though they are holding out for a better offer. They too would like one of the bigger companies to buy them. But they don’t have the same library as Lionsgate. What is the best option for Netflix to win Warner Bros. besides a higher bid? Offering the most money is the key, and Warner Bros. Discovery is prioritizing cash over stock. Could Comcast and Netflix form a joint venture to acquire Warner Bros., with Comcast buying the streaming part and Netflix the studio/library? I heard someone float a version of this deal, and it is appealing. Comcast gets more bulk in streaming, which it badly needs. Netflix gets the library it covets without any of the assets it doesn’t want. But a three-way deal is complicated, and still leaves Warner Bros. Discovery with undesirable cable networks. Why hasn’t talent pushed back more on Paramount and soon Warner Bros. becoming Trump state media? For all the hand-wringing about Trump’s close relationship with the Ellisons, we have yet to see that manifest itself in CBS news programming. The creators of South Park have praised the Ellisons for staying out of their way — after a rocky start. And while Trump may have pushed Paramount to buy Rush Hour 4, that doesn’t qualify as the second coming of Pravda. The best of Screentime (and other stuff)

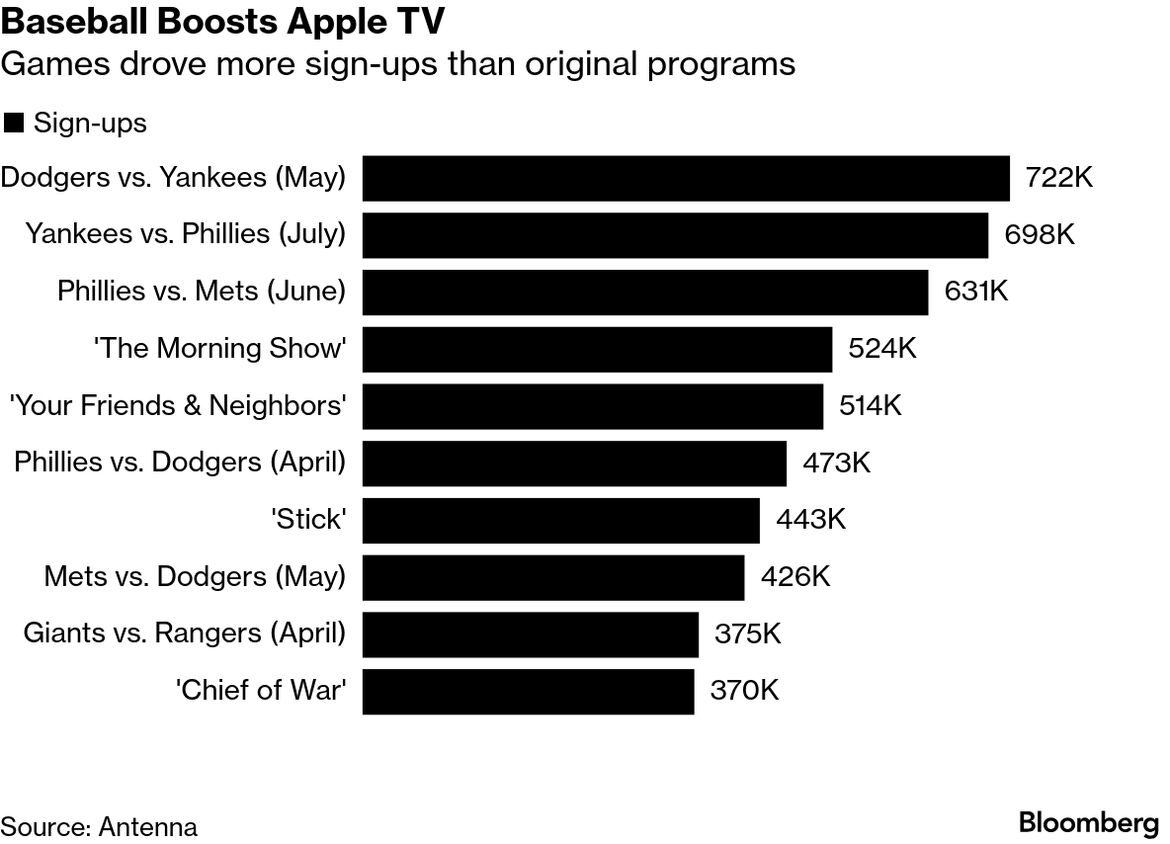

The Trump doctrine of mediaDonald Trump doesn’t want broadcast networks to get any bigger. Specifically, he doesn’t want NBC and ABC, which he says are biased against him, to get any more powerful. These comments prompted a lot of confusion. Brendan Carr, the Trump-appointed chair of the Federal Communications Commission, has been pushing for consolidation of local station ownership. Trump’s remarks were initially interpreted as conflicting with Carr’s, but that’s not necessarily the case. Local station owners like Tegna and Nexstar could merge without the major networks getting any larger or more influential. In fact, mergers of local broadcasters would give station groups — a couple of which have conservative owners — more power in negotiations with networks. Trump didn’t criticize CBS, the broadcast network owned by Paramount Skydance. That company is controlled by the Ellisons, whom the president sees as friendly. The Ellisons are also attempting to buy Warner Bros. Discovery, which would make them far more powerful. So Trump is saying broadcast networks owned by his friends can do deals. Broadcast networks owned by others (aka arms of the Democratic Party) shouldn’t. Speaking of TV consolidation … Scripps is trying to thwart a takeover attempt by Sinclair, the latest proposed merger in local broadcasting. The hottest band in the world is…Geese. The four-person rock band out of New York is being pursued by several major record labels. The group recorded its first three albums with Partisan Records, a New York-based independent label that has worked with many good young rock bands, including Idles and Fontaines D.C. PIAS, a business recently acquired by Universal Music Group, helped with distribution. Geese’s latest album, Getting Killed, is the group’s most successful by far. Major labels want to jump on a hot band early before it’s potentially headlining festivals. Baseball provided a big lift to AppleMajor League Baseball games drove more sign-ups for Apple TV than shows like The Morning Show and Your Friends & Neighbors, according to research from Antenna. A May game between the Los Angeles Dodgers and New York Yankees led more people to sign up for Apple than any other program between April 2025 and September 2025 (aka baseball season). Individual games accounted for six of the 10 biggest sign-up pushes in that span.  Baseball fans are less likely to stick around given the relative paucity of sports on Apple. But the benefits of the sign-ups weren’t completely erased by the cancellations. The data are part of a larger study about the importance of sports to streaming services. Events like the Canelo vs. Crawford boxing match drove more sign-ups for Netflix. Weekly playlistI’ve seen a lot of new movies over the last few weeks. The best of the bunch was Marty Supreme, aka the A24 ping pong movie, which isn’t technically out yet. It Was Just an Accident was second, followed by House of Dynamite. More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|