| Read in browser | ||||||||||||||

Good afternoon from Los Angeles. I am about to disappear to Europe for 10 days, but the newsletter continues. We will examine the results of our year-end poll and present some new research to close out the year. Thank you to NBC Nightly News, Pod Save America, Canada’s version of The Daily and NPR’s 1A for hosting me this week to discuss the Warner Bros. deal mishegoss. Five things you need to know

Five Warner Bros. misconceptionsAfter failing in a months-long effort to clinch a deal for Warner Bros. Discovery, David Ellison is trying a new approach. The chairman and chief executive officer of Paramount Skydance is forcing Warner Bros.′ board to reconsider his offer by appealing directly to the company’s shareholders. It has been described as a hostile bid, and I would amend that to say pseudo-hostile. Ellison would rather not go direct. But his allies are convinced the Warner Bros. board didn’t fully vet his most recent offer and may have even decided on the Netflix bid before they received it. (There is no concrete evidence of this.) Ellison believes his offer is better and has made it clear that he’s not surrendering without a fight. The teams at Netflix, Paramount and Warner Bros. are now bracing for the long haul. Most expect this will take months, not weeks. The Warner Bros. board is preparing to reject Ellison’s proposal this week, kicking the ball back to the 42-year-old son of software billionaire Larry Ellison, one of the world’s richest men. The Ellison camp can proceed with their direct appeal to shareholders or raise their offer and hope to outlast Netflix in a bidding war. Netflix shareholders are already a little restless. But Netflix co-CEO Ted Sarandos wants this deal and he’s not backing down. There has been a lot written about this deal in just the last week, so I thought I would address a few misconceptions. President Trump doesn’t actually decide who wins the auction. The president will have a say in this deal eventually, assuming he is going to influence the federal regulators who will vet the transaction. He is already taking a more active role in deals than his predecessors. But Warner Bros. has to pick a winner before regulators approve anything. Unless federal officials come out against the current Netflix deal — they haven’t yet — the auction is going to come down to who offers the most money. This suits Trump, who gets to tease both sides knowing that he will extract some kind of benefit when the deal is actually in front of regulators. Paramount didn’t offer more money than Netflix. Nor did Netflix offer more money than Paramount. Paramount is offering to buy all of Warner Bros. for $30 a share in cash. Netflix is offering to buy the studio and streaming business, including HBO, for $27.75 a share in cash and stock. Which bid is better depends on the value you assign to cable networks like CNN and TNT, which Warner Bros. plans to spin off. Warner Bros. thinks it’s $3 to $4 a share, which may make the Netflix bid better. Paramount thinks it’s $1 a share, making its proposal better. Neither deal is going to save Hollywood. Both Netflix and Paramount are presenting themselves as saviors. Paramount says it is the only one of the two bidders that believes in movie theaters. While that may be true, the company is proposing $6 billion in cost synergies. That is thousands and thousands of jobs. Netflix says it’s a better buyer because it won’t cut as many jobs as Paramount. It doesn’t own cable networks or really own a studio, which is a big reason why the streaming company is projecting less cost-cutting. Still, this is a company infamous for cutting low-performing employees. Hollywood isn’t keen on either deal and is worried about Netflix’s impact on the movie business. Netflix isn’t reversing its approach to movie theaters. Co-CEO Sarandos has said both privately and publicly that Netflix would put Warner Bros.′ movies in theaters. “We didn’t buy this company to destroy that value,” he said Monday. Sarandos has been unable to persuade producers, agents and even some journalists who have spent years hearing Sarandos dismiss the importance of movie theaters. Netflix could potentially convince its skeptics by putting some of its current movies in theaters — it’s been discussed — but it’s not gonna happen. The company isn’t changing its model for Netflix movies (at least not yet). The Ellison family has the money. If Sarandos is frustrated that nobody will believe his theatrical promise, the Ellisons are enraged that anyone doubts their financing. Larry has all the money in the world, they say. And that is true. However, that’s not the source of the dispute. The Ellisons are relying on third-party financing, including $24 billion from the Middle East. That makes Warner Bros. squeamish. The best of Screentime (and other stuff)

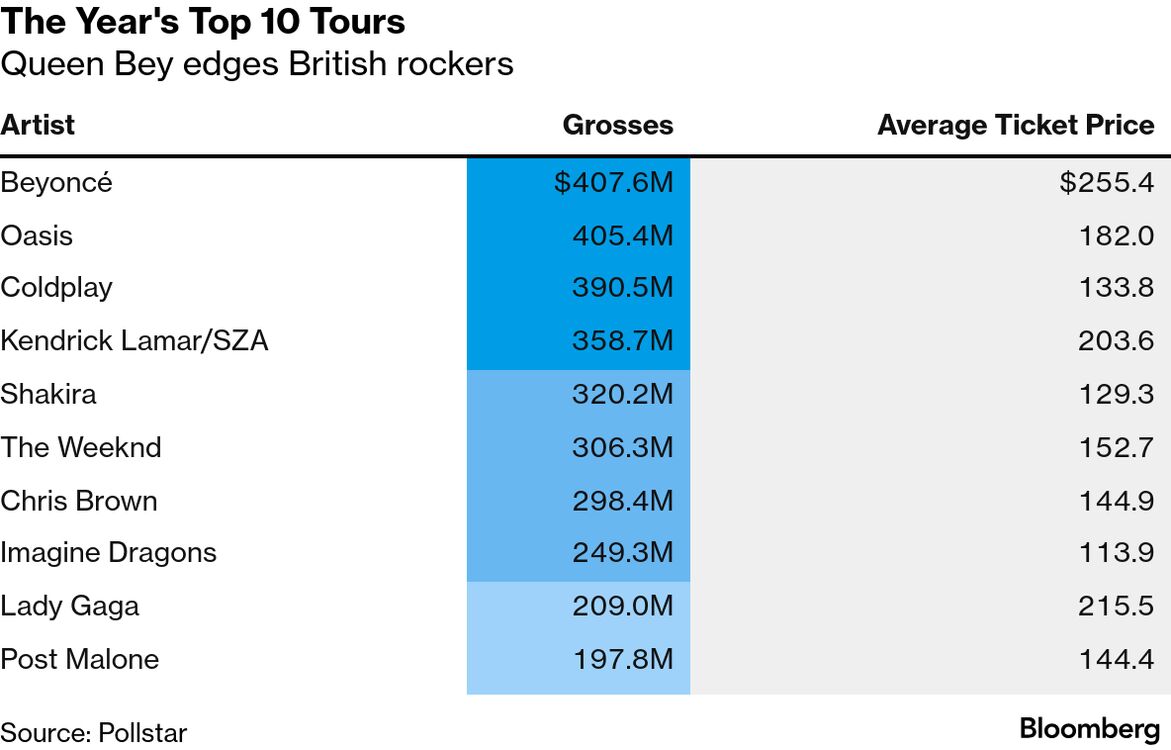

The catalog bubble that never poppedThe Weeknd is finalizing a deal with Lyric Capital Group to raise more than $1 billion backed by his catalog. The parties aren’t calling it a sale because The Weeknd and his manager, Wassim Slaiby (aka Sal), are partners in the business. It is technically a joint venture. Many major music companies balked when The Weeknd first took his rights to market. He had already surrendered some to third parties in past deals. He is selling what he still has, which covers his music released up until now. One industry expert compared Lyric’s deal to a third mortgage. And yet, the artist born Abel Tesfaye found a few willing buyers, ultimately ending up with Lyric, a private equity firm focused on music. It’s not hard to understand why someone would want to be in business with The Weeknd, one of the most popular acts of the last decade. He has a bevy of hit songs and remains one of the top touring acts in the world. Still, his ability to raise that much money underscores the sheer volume of capital being deployed to invest in music catalogs. The catalog market boomed in the late 2010s and early 2020s thanks to the revival of the broader music business. It also helped that interest rates were near zero and investors were looking for safe assets coming out of the global financial crisis. The performance of music isn’t correlated to the stock market. We’ve covered the rise of music as an asset class before. Legacy acts like Bob Dylan and Bruce Springsteen took advantage, as did newer ones like John Legend and Justin Bieber. The market for copyrights seemed to soften in 2022, as interest rates crept up and the war in Ukraine triggered market uncertainty. Some companies and artists asked for too much and failed to complete deals. The collapse of Hipgnosis, one of the biggest buyers of copyrights, was expected to scare away many investors going forward. And yet all of those factors only led to a brief lull. Outside capital has flooded into the market over the last couple of years. Warner Music Group formed a partnership with Bain Capital to deploy more than $1 billion. Universal set up a venture with Dundee Partners that already owns some of The Weeknd’s work. They’ve spent hundreds of millions of dollars this year and are raising more capital. The majors are largely focused on buying rights from artists they already have in their portfolio. See Warner and the Red Hot Chili Peppers. But others, including Primary Wave Music, BMG and Harbourview Equity, are shopping on the open market. Primary Wave, which has been buying catalogs for a couple decades, is raising a new fund in the billions of dollars. It’s not just equity either. A ton of debt is being deployed. Hundreds of millions of dollars in The Weeknd deal is debt. To get a feel for the current state of the catalog market, look at the recap of Harbourview’s annual general meeting. It was a multiday party where investors in the fund and business partners could take golf lessons, enjoy wellness sessions and see hit producers in the studio. It also featured live performances from Chaka Khan, Luis Fonsi and Fat Joe. The No. 1 tour of the year was…Beyoncé. She edged out Oasis by just $2 million thanks to an average ticket price of more than $255. Her tour grossed $407.6 million across 32 dates. Coldplay sold the most tickets — nearly 3 million — but didn’t gross as much because the group charged a more modest $134 a head. Here’s the full top 10

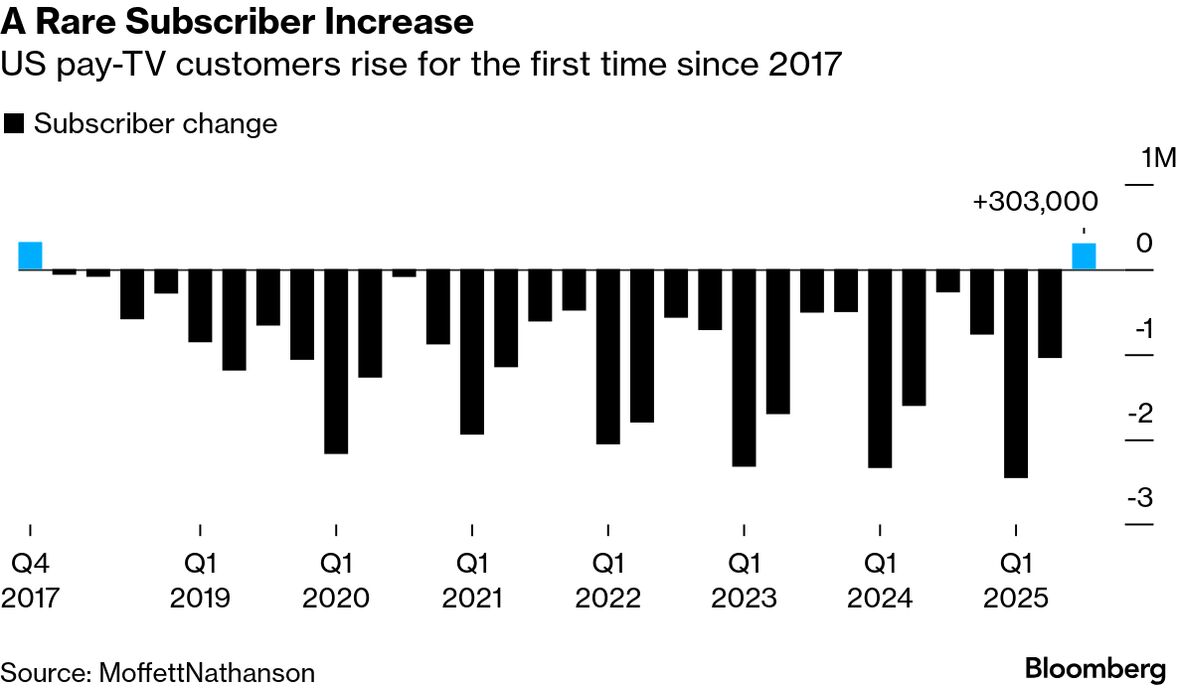

The No. 1 album of the year was…Taylor Swift’s The Life of a Showgirl, per the Recording Industry Association of America. As the RIAA’s name suggests, the tally just covers the US. Spotify said Bad Bunny was the No. 1 artist globally. The biggest single of the year was Alex Warren’s Ordinary. The No. 1 TV show in the US is…Stranger Things. The show was the most popular show on streaming before new episodes were released, a testament to the enduring popularity of the Netflix series. But it’s been so long since there were new episodes. Who could even remember what happened? Cord cutting is over?The number of people who paid for a live TV package increased in the third quarter for the first time in eight years, according to MoffettNathanson. The growth is entirely because of virtual packages like YouTube TV and is seasonal. The numbers for the third quarter are always better thanks to football. The audience for pay TV will likely fall again in the current quarter. Still, wow.  Deals, deals, deals

Weekly playlistI spent the last few weeks tearing through Mark Ronson’s memoir Night People, which is a breezy look at New York nightlife in the 1990s. I assembled a mammoth playlist that consists of every song mentioned in the book. It’s a mix of ’60s rock, ‘70s funk and ’90s hip-hop, among other things. It’s about 15 hours, so use it for a road trip. More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|