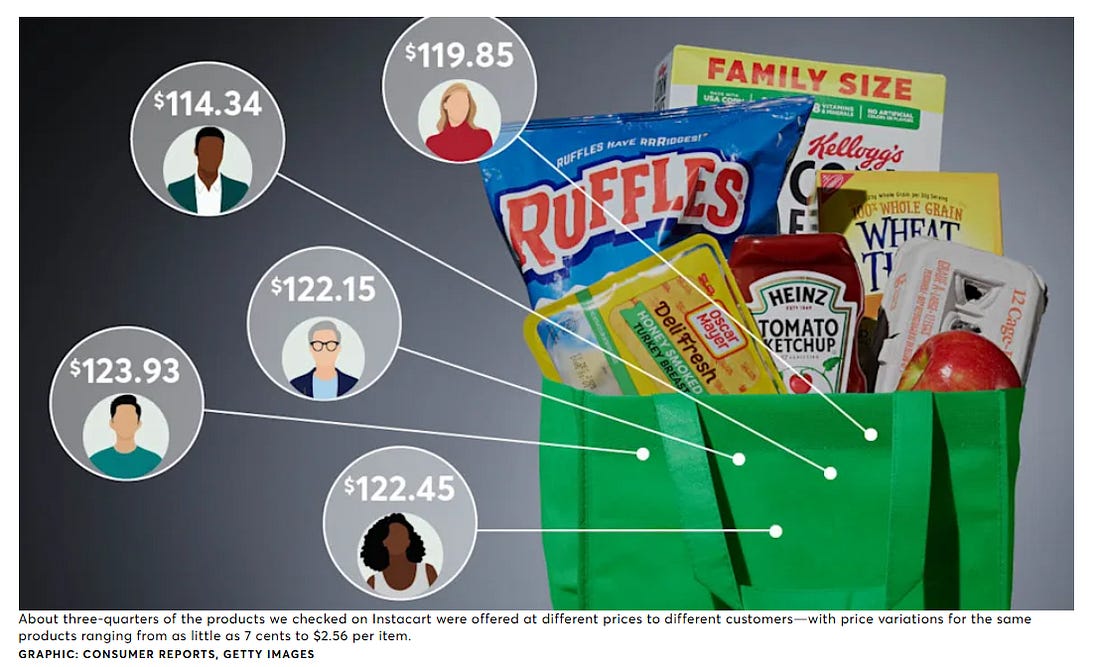

Welcome to You’re Probably Getting Screwed, a weekly newsletter and video series from J.D. Scholten and Justin Stofferahn about the Second Gilded Age and the ways economic concentration is putting politics and profits over working people. Welcome to You’re Probably Getting Screwed, a weekly newsletter and video series from J.D. Scholten and Justin Stofferahn about the Second Gilded Age and the ways economic concentration is putting politics and profits over working people. Welcome to 2026! For the last two years I have tried to open the year discussing the important role states can play in helping address our monopoly crisis. This is in part because with the start of the new year also comes the start of legislative sessions across the country. Today I will be doing the same thing, but with a specific focus on how legislators can tackle high grocery prices which have risen nearly 30% since the start of 2020. These high costs figure to be a major concern for voters in 2026, as the issue has for several years now. However, while it might be convenient to simply blame high costs on tariffs and trade wars, there is a much more systemic problem lurking at the grocery store and legislators need to address it head on. Today I will explore some of the unfair pricing tactics driving up costs and the tools legislators can give state enforcers to bring down costs and protect small businesses. For all you Iowans, the Telegraph Herald has an in-depth piece that found Dubuque had 104 grocery stores in 1952 and today there are just 12 (mostly Walmart & Hy-Vee) with unfair pricing tactics a key culprit in that shift. States can put an end to this! I should mention that if you want a broader look at the corporate power issues confronting state policymakers across the country, you absolutely need to check out Pat Garofalo’s annual State Legislative Policy Preview in his newsletter Boondoggle. Court documents released to the public last month demonstrate how unfair practices not only harm small businesses, but also raise costs for everyone. Last year the Federal Trade Commission under former chair Lina Khan filed a lawsuit against Pepsi in the final days of the Biden Administration. The complaint alleged Pepsi had violated the Robinson-Patman Act, an antitrust law from the 1930s meant to protect small businesses from the practice of price discrimination, which is charging retailers different prices for the same goods. As the Institute for Local Self Reliance (ILSR) has documented, strong enforcement of the law in the decades following its passage created a dynamic grocery industry where small independents, regional chains and national chains could all compete for customers, but enforcement was halted by the Reagan Administration and became part of the pro-monopoly consensus that has dominated Washington for decades. The FTC lawsuit was an effort by Khan and others to revive RPA enforcement, but after the Trump Administration inherited the case, new FTC Chair Andrew Ferguson quickly dropped the lawsuit. His timing meant that the full complaint was never made public, just a highly-redacted initial copy. But right before the holidays, ILSR won a lawsuit forcing the release of the complaint and it shows how powerful retailers like Walmart work with powerful food manufacturers like Pepsi to raise prices, counter to the argument from companies like Walmart that price discrimination is essential to lowering prices for consumers. For the past decade, according to the unsealed complaint, Walmart has used its immense power to demand promotional payments and allowances from Pepsi that have kept prices of soft drinks lower than other retailers. Walmart has also used Pepsi as a “retail price cop” to help it monitor prices of soft drinks at competing retailers. When the gap between Walmart and others is too low, Pepsi limits allowances and raises wholesale prices for those companies. “Rather than simply working with Walmart to reduce prices, Pepsi’s actions have had the effect of raising prices for customers of competing retailers,” the complaint says. While the FTC complaint focused on soft drinks, this is just a glimpse at a more pervasive practice. For years the National Grocers Association has been calling for increased RPA enforcement. A 2022 survey of independent businesses by ILSR found two-thirds of small businesses identified the special discounts and terms their larger competitors get as a major challenge. In November a paper from the Federal Reserve Bank of Atlanta found that poorer areas have higher food prices and that grocery consolidation is the driver of those higher prices. For decades we have been told that small grocers just cannot compete and are inefficient and letting the big chains take over will mean lower prices and more variety for everyone, but that is clearly not true as Americans struggle to afford their groceries and more and more live in food deserts, something that did not exist decades ago. Here is where states come in. Policymakers in Minnesota, New York, Rhode Island and Maine have introduced bills that would give states more authority to crack down on price discrimination in the grocery industry. Building off the principles of the Robinson-Patman Act, these legislative efforts would require suppliers to offer goods to retailers on equivalent terms and prohibit retailers from extracting unfair concessions from suppliers. These bills would also address loopholes in the RPA, helping establish a model that could be used to strengthen federal law at some point. This includes disallowing suppliers to engage in price discrimination if retailers are in different “channels” such as giving a preferential price to a dollar store chain compared to a traditional grocery store. The bills would also ban the kind of access discrimination experienced during the pandemic, i.e., Walmart threatening to fine suppliers that did not give them preferential access to goods, which meant Walmart’s shelves were full, but your local grocer’s were empty. Cracking down on price discrimination is not the only way state legislators can help drive down costs at the grocery store. A recent investigation by Consumer Reports, the Groundwork Collaborative, and More Perfect Union revealed AI-driven pricing experiments the online grocery delivery service InstaCart is foisting on customers. The investigation found that some grocery prices differed by as much as 23 percent per item from one Instacart customer to the next. The investigation was a first step in better understanding the growing potential of “surveillance pricing” or using AI systems and the vast amount of personal data collected on each of us to set opaque individualized prices that rig the market to charge us as much as possible. According to the American Economic Liberties Project, strong bills to crack down on surveillance pricing have been introduced in Colorado, Illinois and California. Surveillance pricing is just the latest iteration of data-driven pricing tactics monopolists are using to rip us off. A class action lawsuit in 2024 alleges that the frozen potato cartel, which controls 97% of the industry, has used a third party analytics company to tacitly collude. According to the lawsuit four companies (LambWeston, McCain Foods, Simplot and Cavendish Farms) send sensitive industry data to a company called PotatoTrac that uses that data to create pricing reports for the cartel. Between July 2022 and 2024 the price for frozen potato products rose 47% and the increases among the carter were nearly identical. There are plenty of other examples of this algorithmic pricing in rental housing, the meat industry and pharma. In November California enacted a ban on algorithmic price-fixing and Colorado is also considering legislation. While many cities and states across the country have worked to outlaw the pricing tactic in rental housing, they should consider expanding those efforts to take on food monopolies. At a time when SNAP benefits are being cut, tariff uncertainty continues to cause turmoil and prices are rising, 2026 should be the year legislators finally do something about the systemic drivers of high food prices. YOU’RE PROBABLY (ALSO) GETTING SCREWED BY:Copay Accumulators Insurance companies have found a new way to squeeze more money out of you. Rob Gundermann, the CEO of the Coalition of Wisconsin Aging & Health Groups explained how this works on Here and Now on PBS Wisconsin. The full interview is here. PBMs Hunterbrook Media has a remarkable new investigative piece out on PBMs, the middle men driving up drug costs and killing community pharmacies. What Hunterbrook found is that PBMs are using shell corporations to steal rebates they promised would go to patients. You might know that one of the key issues with PBMs is they negotiate rebates with drug manufacturers in exchange for placement on their formulary, but recent scrutiny of PBMs has found little of those rebates have made their way back to patients. But as policymakers have implemented policies to ensure patients see those rebates, PBMs are now using these shell companies as an end around. I highly recommend checking out the full piece at this link, but you can also find a video version below.  ChatGPT While Sam Altman goes around on podcasts and TV shows spouting the utopian society his company will help create, what he really appears to be doing is building a trillion dollar porn bot. Great use of our water and utility bills! Data Centers Speaking of AI, Good Jobs First is out with a new analysis finding that Virginia lost $1.6 billion on data center subsidies in fiscal year 2025. One fiscal year! The amount is an increase of 118% percent over the previous year and like most states the subsidies are structured as a sales and use tax exemption.

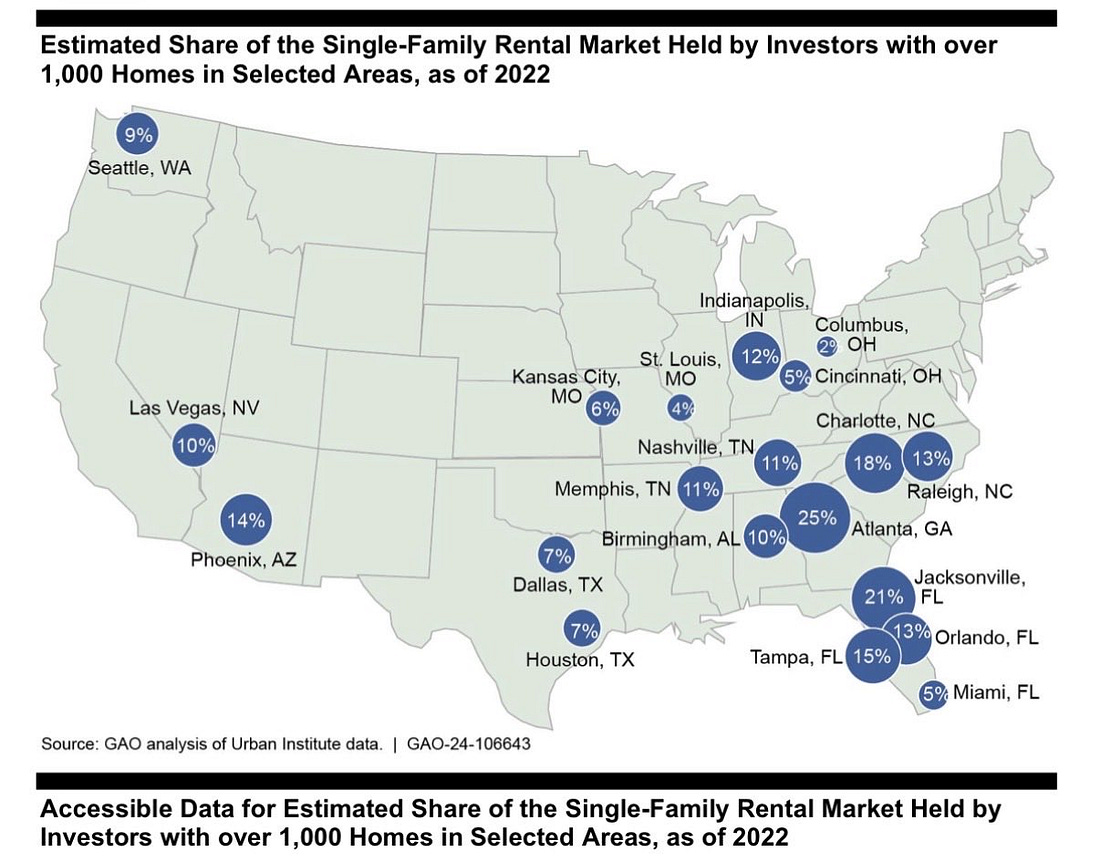

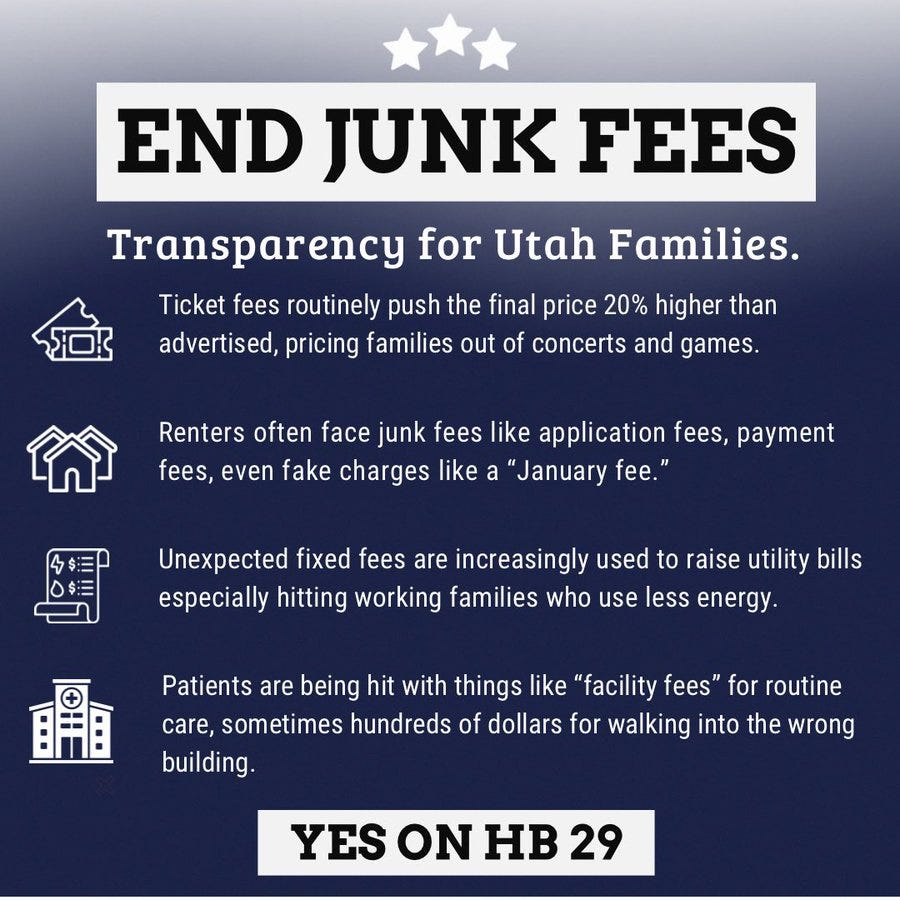

Institutional Investors President Trump announced yesterday that he will seek to ban institutional investors from buying single-family homes. Whether that happens or not, who knows, but it should. Fortunately, states can also pursue this policy just like states have protected farmland from corporate ownership. Several years ago, long before it was burying stories, 60 Minutes did good reporting on the rise of corporate landlords. While not the only driver of high housing prices, this is another good reminder that corporate power is playing a role in our housing affordability crisis. For example, there is this new paper on consolidation of homebuilders. SOME GOOD NEWS Embracing Economic Populism At Liberty & Power, the Open Market Institute’s substack, Austin Ahlman and Ben Winsor talked to Democratic strategists across the party’s ideological sides. What they found is they all want, in fact they are pleading, for the party to embrace economic populism. The piece is framed around 7 lessons, all of which are important, but number 4 stood out to me. Utah considers junk fee ban Speaking of the benefits of embracing economic populism, Utah Republicans have introduced legislation banning junk fees. BEFORE YOU GOBefore you go, I need two things from you: 1) if you like something, please share it on social media or the next time you have coffee with a friend. 2) Ideas, if you have any ideas for future newsletter content please comment below. Thank you. Break Em Up, Justin Stofferahn |