| Read in browser | ||||||||||||||

Good evening from Los Angeles, wherever you may be. I am about to leave for the Golden Globes, which are honoring podcasts with an award for the first time. (Amy Poehler is the favorite to win.) The podcast industry is excited about the recognition from mainstream Hollywood — both Spotify Technology and SiriusXM Holdings held parties that were as crowded as those thrown by movie studios or streaming services. This week, we’re going to focus on one of the biggest business stories in podcasting (and streaming video). It’s a new year, which means it’s time for fresh ideas. If you have any stories I need to cover, message me at lshaw31@bloomberg.net. If you don’t yet subscribe to this newsletter, fix that. Five things you need to know

Netflix’s podcast experiment beginsOn Sunday night, sportscaster Bill Simmons will go live on Netflix for the first time, chatting with his friend Sal Iacono at the conclusion of the NFL playoff game between the Los Angeles Chargers and Simmons’ beloved New England Patriots. The episode marks the unofficial beginning of Netflix’s move into podcasting. Over the next few months, the company will offer dozens of podcasts, including the hit shows Pardon My Take, My Favorite Murder and The Breakfast Club. Netflix’s embrace of podcasting is a major moment for the service — a new type of programming akin to when the company tried reality TV or stand-up comedy. It is the closest to news Netflix has gotten (unless you count documentaries) and it’s a spiritual descendant of the topical talk show, a genre that has bedeviled streaming services for the last decade. Sports fans can listen to Simmons or Pardon My Take instead of watching SportsCenter. They can watch Good Hang with Amy Poehler instead of watching Jimmy Fallon. Yet it’s a far bigger moment for the podcasting industry, which is praying the experiment will work and turn Netflix into a major new buyer. Agents and executives have been wish-casting a big payday ever since co-CEO Ted Sarandos signaled Netflix’s interest in podcasting early last year. For now, they are all asking a variant of the same question: Will Netflix commit to podcasting or dabble for a couple of years and retreat? Every podcast executive remembers when Spotify arrived with a big checkbook, prompting a bidding war between the Swedish streaming company, Amazon.com and SiriusXM. Those companies collectively spent at least a couple billion dollars buying up companies and rights to podcasts. Netflix has been reluctant to commit that kind of money. It balked at spending upward of $20 million a year on Alex Cooper’s Call Her Daddy, which did a deal with SiriusXM. Netflix has been more comfortable spending in the six-to-low-seven figures. Several shows rejected Netflix offers as insufficient. All the Smoke, a sports podcast hosted by former basketball players Matt Barnes and Stephen Jackson, turned down an offer of a couple million dollars, according to people familiar with the talks. Netflix then increased its offer, but still couldn’t come to a deal, said the people, who asked not to be identified discussing private negotiations. Podcasters are reluctant to sacrifice an audience on YouTube and other platforms if they aren’t going to be paid substantially more money. All the Smoke declined to comment beyond a statement about its “already great working relationship” with Netflix on other endeavors. Most of the podcasts that have done deals with Netflix have yet to develop large video audiences or aren’t monetizing videos well. Netflix’s biggest deals are with networks like The Ringer, iHeartMedia and Barstool Sports. Netflix is paying Barstool, which has some of the most popular sports podcasts in the country, more than $10 million a year, according to people familiar with the terms. Modest spending doesn’t mean Netflix isn’t going to increase its outlays with time. Netflix is a testing culture, which means it wants to see how customers react before committing much money. The service released a promotional video over the weekend under the tagline “Podcasts Worth Watching,” but Netflix has yet to mount a big marketing campaign. Nor are executives doing interviews to discuss the initiative. Netflix is seeding the platform with some shows and relying on its algorithm to let sports fans know what’s coming. (The app flagged Simmons’ arrival to me a week in advance.) A larger marketing campaign is coming. Netflix is saving some of its bullets for original shows. When the company unveils its first slate of originals — and that is close — it will put more promotional muscle behind them. Netflix’s interest has already encouraged Hulu and other streaming services to start taking meetings with podcasters as well. Hulu also has video podcasts that are companions to Disney shows like Dancing With the Stars and Only Murders in the Building. Podcasting’s appeal to Netflix — and all video services — is obvious. It’s a format that gets more popular by the year and doesn’t cost a lot of money. Podcasts could increase the time users spend on Netflix and give the company a boost in its competition with YouTube. And if it doesn’t, the shows will join fitness programming and interactive TV on the Netflix trash heap. It is a low-risk test. The best of Screentime (and other stuff)

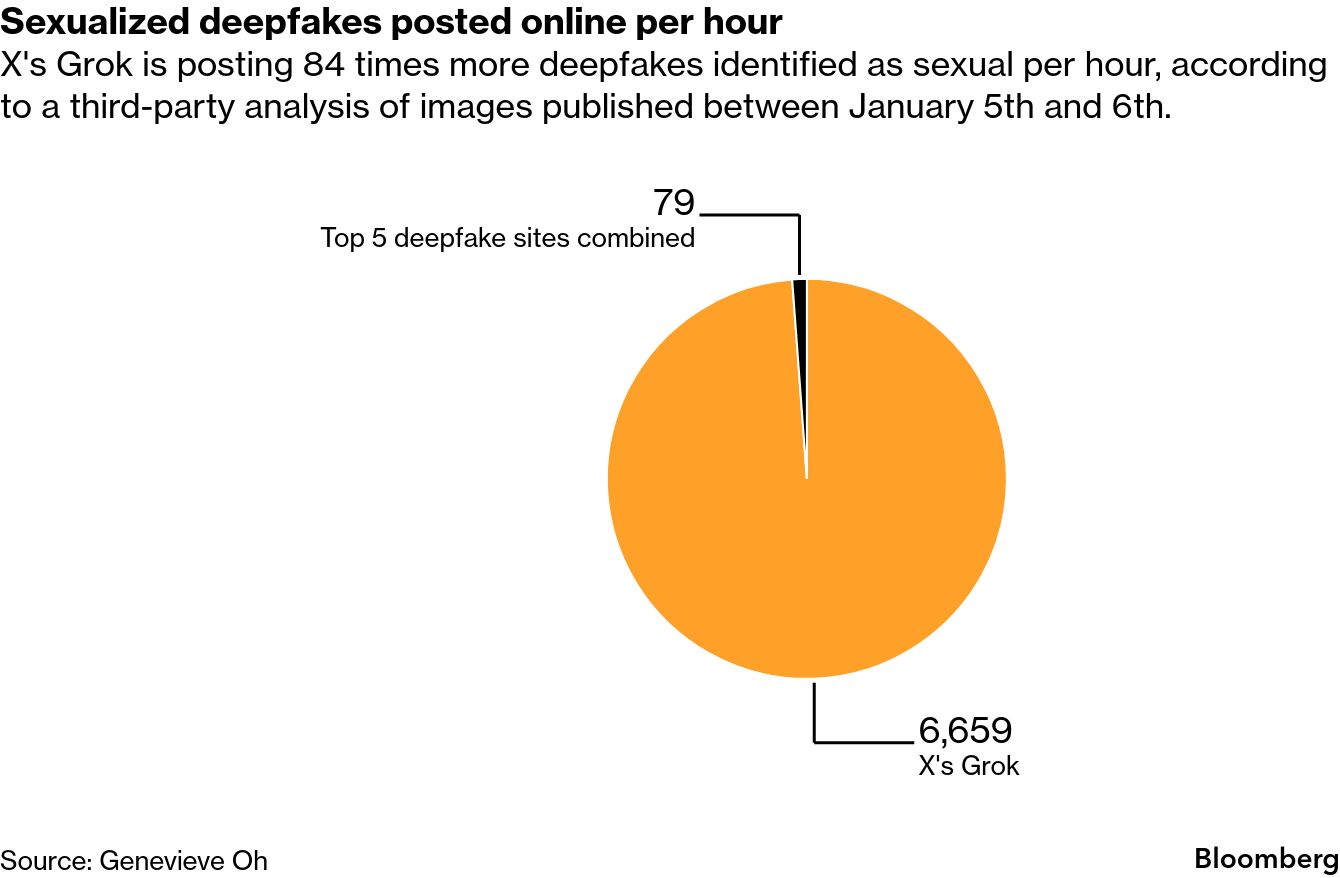

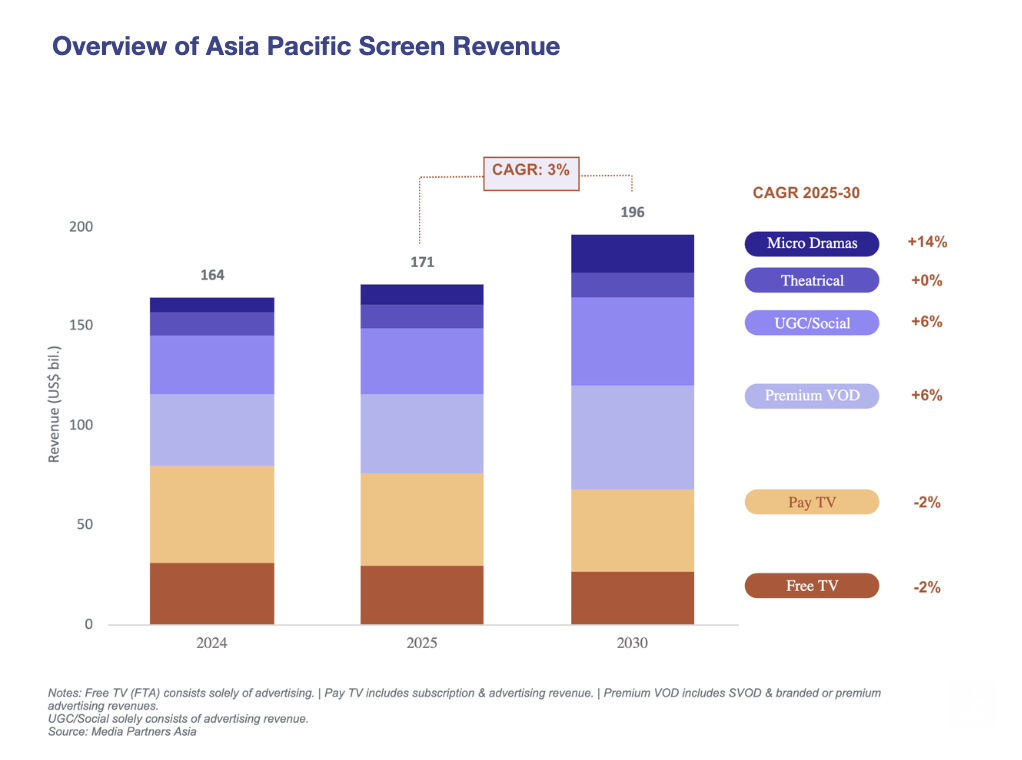

The Warner Bros. ménage à troisWarner Bros. Discovery rejected Paramount Skydance’s buyout proposal for the eighth time. The Warner Bros. board said Paramount has yet to satisfy many of its concerns. Paramount, backed by David Ellison and his father Larry, isn’t going away. The company reiterated the assertion that its bid is superior to a competing offer from Netflix. So what happens next? Paramount can proceed with its tender offer and try to force Warner Bros.′ hand by wooing shareholders. That’s a risky move as investors are split. The obvious step for Paramount would be to raise its bid, eliminating any doubt that its offer is financially superior. But it’s not clear that would do the trick. Warner Bros. is also insisting that Paramount increase the amount of cash in the deal. It’s also possible Netflix could just match any sweetened terms. Paramount can also wait a beat to see if the Trump administration or other regulators come out against the Netflix deal. Shares of Comcast’s cable network spinoff Versant Media tumbled in their opening week, which helps Paramount’s case that Warner Bros. is overvaluing its cable networks. X’s deepfake problemX is limiting the availability of its AI image generator after a scandal involving sexually suggestive deepfakes. X’s AI chatbot, Grok, was generating thousands of images of people who’d been undressed without their consent. Consider the scale of sexual deepfakes on X as compared to other sites:  Streaming eclipses TV in AsiaThe Asian video entertainment business is going to grow by about 3% a year over the next five years, according to Media Partners Asia. Growth from premium video-on-demand, user-generated content and micro dramas will offset a decline in traditional TV.  The No. 1 tour in the world belongs to...Bad Bunny. The Puerto Rican superstar is grossing more than $8 million a night with his new tour, according to Pollstar. He took in more than $100 million in the last five weeks of 2025. Two of the 10 biggest tours in the world right now belong to comedians. Both Shane Gillis and Nate Bargatze are packing arenas and making more than $1 million a night. The No. 1 TV show in the US is…The NFL, which delivered its best ratings in 36 years. Viewership was up for every broadcast partner, led by Amazon’s Thursday Night Football, which delivered a 16% jump. How are the ratings for football going up when more than 30 million people have stopped paying for live TV? Nielsen adjusted its ratings to include bars and restaurants. Deals, deals, deals

Weekly playlistFolk singer Mon Rovia is out with a new album that is perfect for a leisurely Sunday morning. The return of The Pitt and Industry in the same week? Stop torturing us HBO Max. More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|