| Read in browser | ||||||||||||||

Hollywood is on the verge of a real estate crash. Investors poured billions of dollars into sound stages, believing that the streaming boom would continue for years into the future. These weren’t speculators or amateurs. They were savvy real estate companies and major financial firms. But Hollywood pulled back on spending, production shifted to other countries, and now Los Angeles is about to have a ton of empty production stages. Goldman Sachs is taking over a historic Los Angeles studio lot after its owner defaulted on a mortgage. There’s still more space about to open, and it’s not clear who will use it. My colleagues John Gittelsohn and Thomas Buckley have done a lot of great reporting on this topic. If you have any more information on it, message me at lshaw31@bloomberg.net (or message them at johngitt@bloomberg.net and tubuckley25@bloomberg.net) For this edition, we’re going to look at another corner of the entertainment ecosystem affected by the Hollywood recession: independent producers. But first… Five things you need to know

PSA: I will have much more to say on Warner Bros. next week. Send along questions. The unlikely French consolidatorMedia mogul Peter Chernin raised almost $1 billion to build North Road into the next great independent film and TV studio. Now he’s selling the company for less than it was worth a couple years ago. Chernin is in talks to sell North Road, which produces the Netflix hit Love Is Blind, as well as many hit films and TV shows, to the French media company Mediawan in a deal worth $700 million to $1 billion. North Road is one of a number of companies that had grand ambitions before the industry contracted around them. Chernin navigated these challenges better than most, but still spent the past year talking to potential buyers before settling on Mediawan, a private equity-backed firm that has acquired dozens of companies. The streaming revolution has prompted a wave of consolidation in Hollywood that is unprecedented in modern history. The dominos started to fall when Time Warner was sold to AT&T, followed by Fox’s deal with Disney, the merger of CBS with Viacom and the current fight for Warner Bros. Discovery between Netflix and Paramount Skydance. As the major studios in Hollywood got bigger, other players in the food chain had to try and match them. Talent representatives at Creative Artists Agency bought International Creative Management while management companies combined as well. Some of Hollywood’s savviest executives saw opportunity in this consolidation. They could roll up producers all over the world and create an independent studio to supply voracious streaming services. Chernin, who previously ran Rupert Murdoch’s media empire for many years, had already started a successful production company that made films like Rise of the Planet of the Apes and Hidden Figures. He raised money from Providence Equity Partners, Apollo Global Management and the Qataris to expand into new areas like unscripted TV and foreign-language programming. Disney alums Kevin Mayer and Tom Staggs acquired the creator of CoComelon and Reese Witherspoon’s production company with money from Blackstone. Talent-led companies like Kevin Hart’s Hartbeat and LeBron James’ SpringHill raised tens of millions of dollars. Yet none of these companies ever got to a scale that gave them the ability to dictate terms or change the market. Mayer and Staggs’ Candle Media overpaid for assets and struggled to live up to its projections. James merged his company with another producer after years of losses. Hart cut staff and parted ways with some of his leadership team after an ambitious expansion failed to pay off. He just partnered with Authentic Brands Group to manage his name, image and likeness. Chernin did well compared to most of these players. He didn’t overspend or raise money at unrealistic valuations like Hart and James. He didn’t end up taking all the money that was available to him — he snagged $150 million of the $500 million offered by Providence — nor did he spend all the money he raised. He is a cost-conscious and disciplined operator who looked at a lot of deals but didn’t pull the trigger on many. (This hasn’t always made him popular with sellers.) Yet as streaming services and studios started buying less, all sellers felt the squeeze. Independent producers have been circling each other to do deals. Candle has been trying to sell some of its smaller assets, and everyone is waiting to see if backers like Blackstone try to exit their investment all together. Legendary, another major independent, has been sniffing around for potential deals. It looked at buying Lionsgate, for example. Some executives say the Chernin sale could kick off another wave of consolidation. Major unscripted TV producers are also in talks to join forces. Legendary still sees itself as a potential buyer, not a seller. On Jan. 15, it announced a partnership with Japanese broadcaster TBS to turn some of that market’s intellectual property into film and TV properties. TBS also acquired a small stake in Legendary. Mediawan, backed by private equity firm KKR, has emerged as a somewhat unexpected consolidator. It has acquired dozens of companies over the past decade to become one of the largest independent production outfits. North Road would give Mediawan a real presence in the US. It had previously acquired Brad Pitt’s Plan B Entertainment at the tail end of the streaming boom. If a deal is reached, Chernin is expected to stick around as chairman of North Road, where he can help Mediawan chase the dream of building a global studio (and try to avoid being another over-leveraged buyer). The best of Screentime (and other stuff)

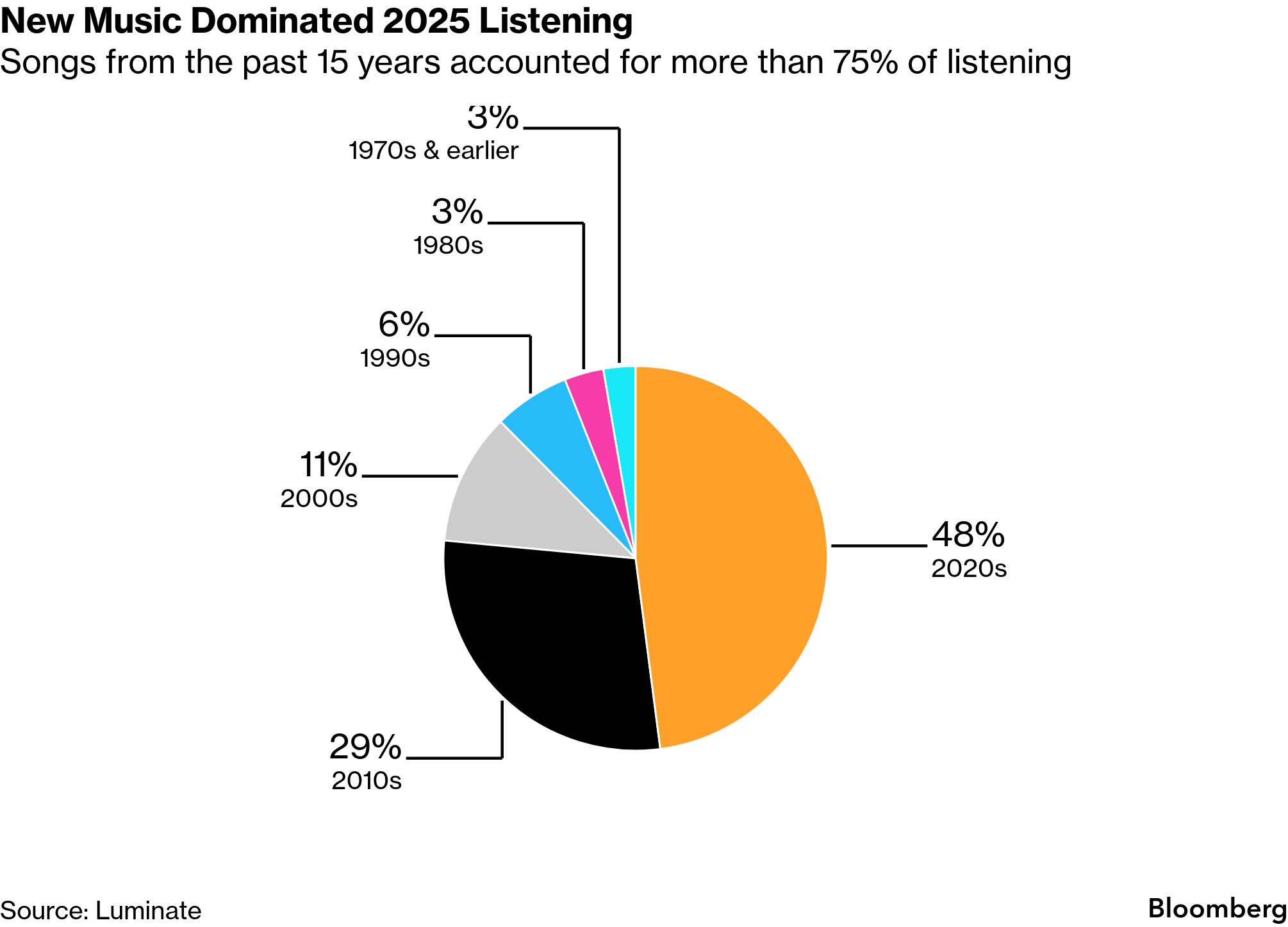

Netflix wants all the moviesNetflix has secured the streaming rights to Sony movies after they leave theaters and pay per view, ensuring it will be the future online home of Spider-Man and Jumanji. Netflix already had a deal with Sony in the US and select international territories. It will now take the rights globally — and pay a lot more. The movies will be available on Netflix’s advertising-supported tier as well. The value of this deal ranges from about $6 billion to $8 billion over five years, depending on how you choose to judge it. It includes rights to some older movies and TV shows, which account for at least $1 billion. The exact fees paid for movies depend on their box-office performance. If Sony has a year like 2025, it will come in at the low end. If it has a big year — as expected this year — it will do better. Either way, it’s a huge payday for Sony. It also makes Netflix the streaming home of two major studios — Universal and Sony. If Netflix buys Warner Bros., it will be the streaming home of Warner Bros. and A24 as well. That’s a lot of movies. This deal doesn’t commit Netflix to buying original movies from Sony, a clause in the previous deal that led to KPop Demon Hunters. Speaking of Netflix movies…Ted Sarandos attempted to address the skeptics who don’t believe he’s going to put Warner Bros. movies in theaters if he buys the company. He reiterated for the umpteenth time that he will, and tried to soften some of his past criticism of theaters. It’s a tall task given Netflix’s strategic approach and Sarandos’ extensive comments in the past. The simplest solution for Sarandos would still be to release a few Netflix titles in theaters in the manner of Warner Bros. It has a few movies that are just as expensive as the biggest Warner titles. But Sarandos doesn’t want to do that. It would blur Netflix’s strategy. The No. 1 album of last year was…Taylor Swift’s The Life of a Showgirl. That’s according to Luminate. Morgan Wallen was a close second. Swift sold a lot of albums — nearly 4 million — but her music wasn’t as popular as Wallen’s or most of the top 10. (These are US-only figures.) The No. 1 song in the world last year was Die With a Smile, a collaboration between Lady Gaga and Bruno Mars, followed by Golden, the hit track from KPop Demon Hunters. Some other fun takeaways…

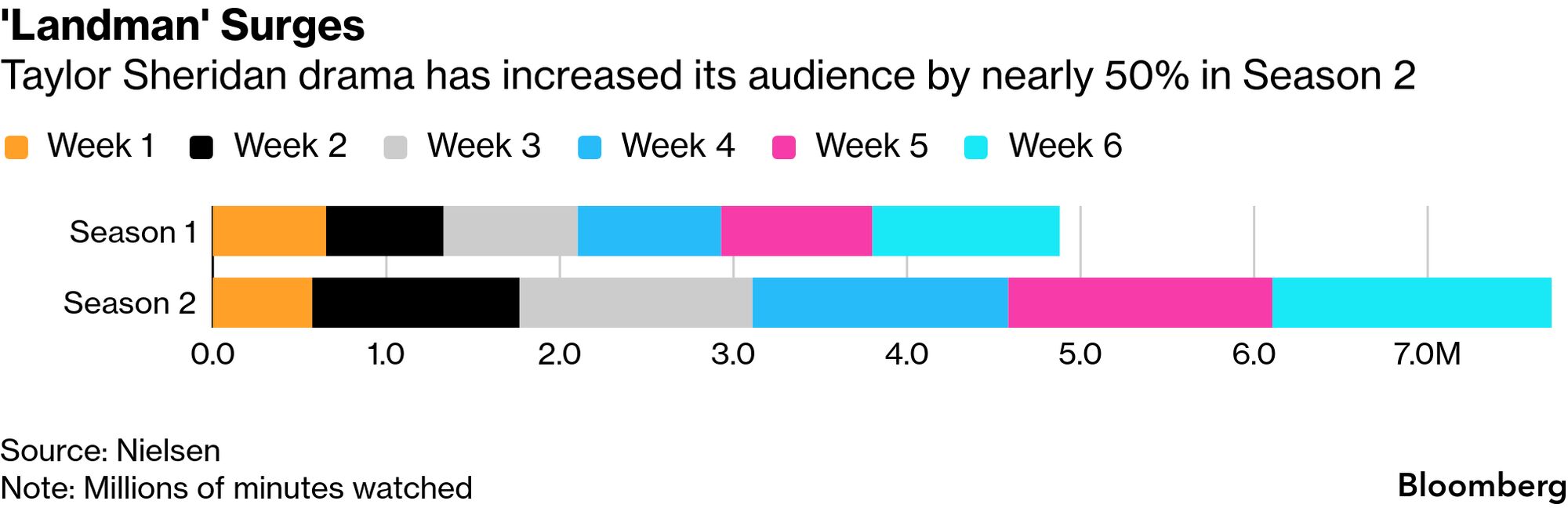

The No. 2 steaming TV show in the US is…Landman. The audience has grown by almost 50% in Season 2, according to Nielsen data. That could include people catching up on Season 1. But whatever the reason, that is a big jump.  Landman wasn’t the most popular TV show to close 2025. That would be Stranger Things, a subject we will revisit when we have all the data. Deals, deals, deals

Weekly playlistIn honor of Martin Luther King Jr. Day, I recommend Jonathan Eig’s King. More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|