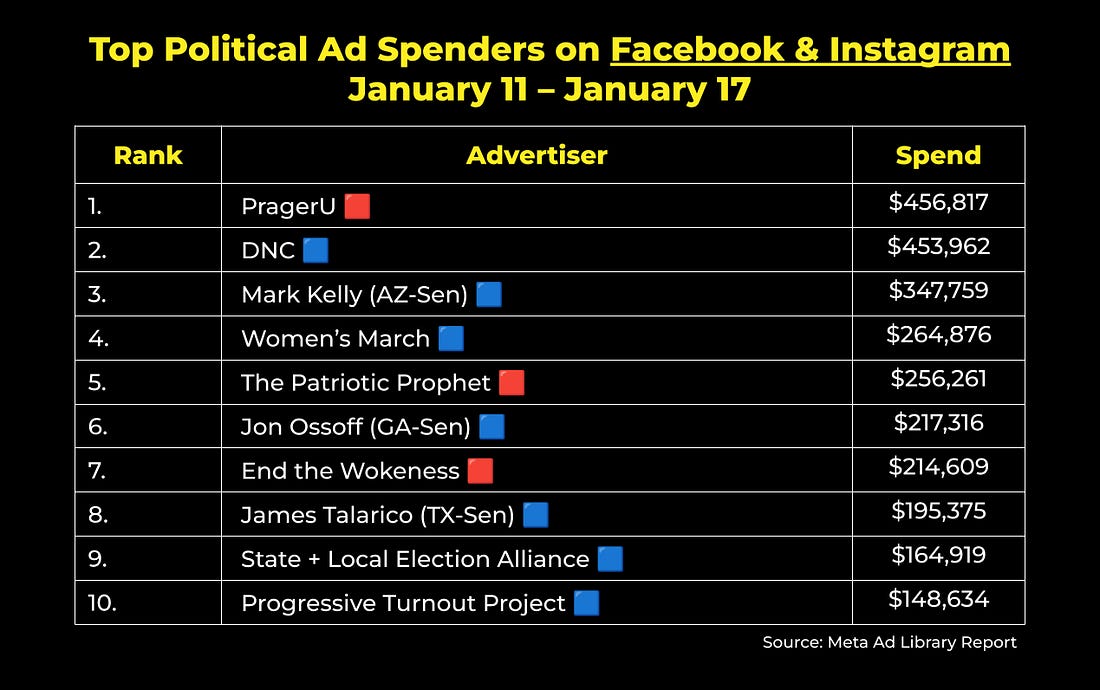

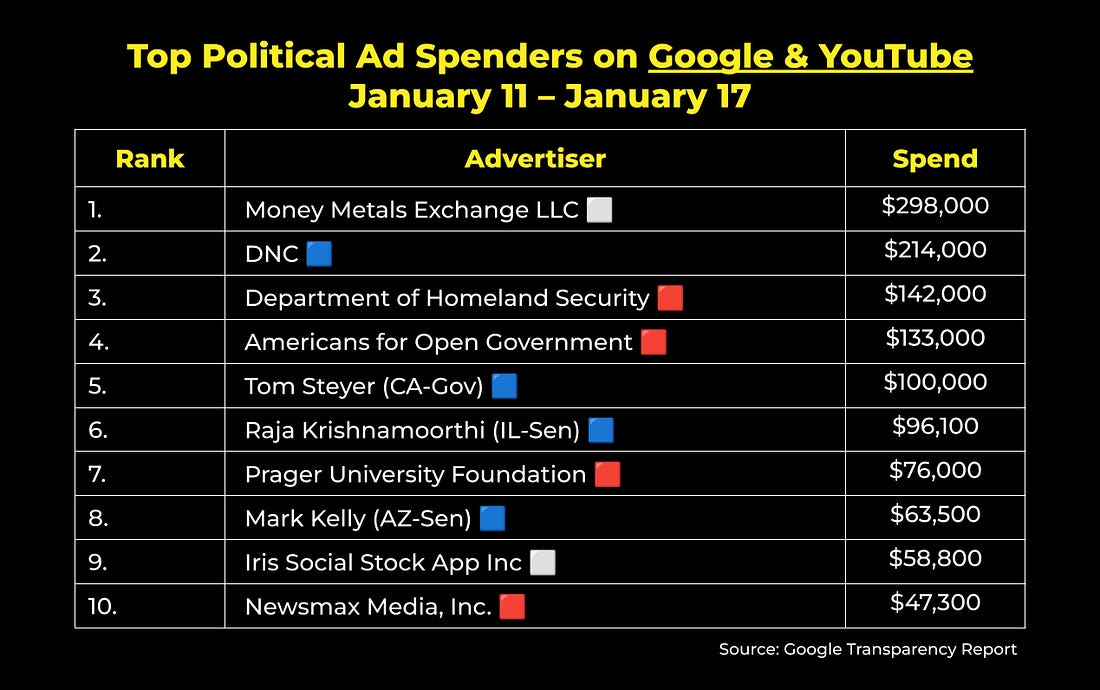

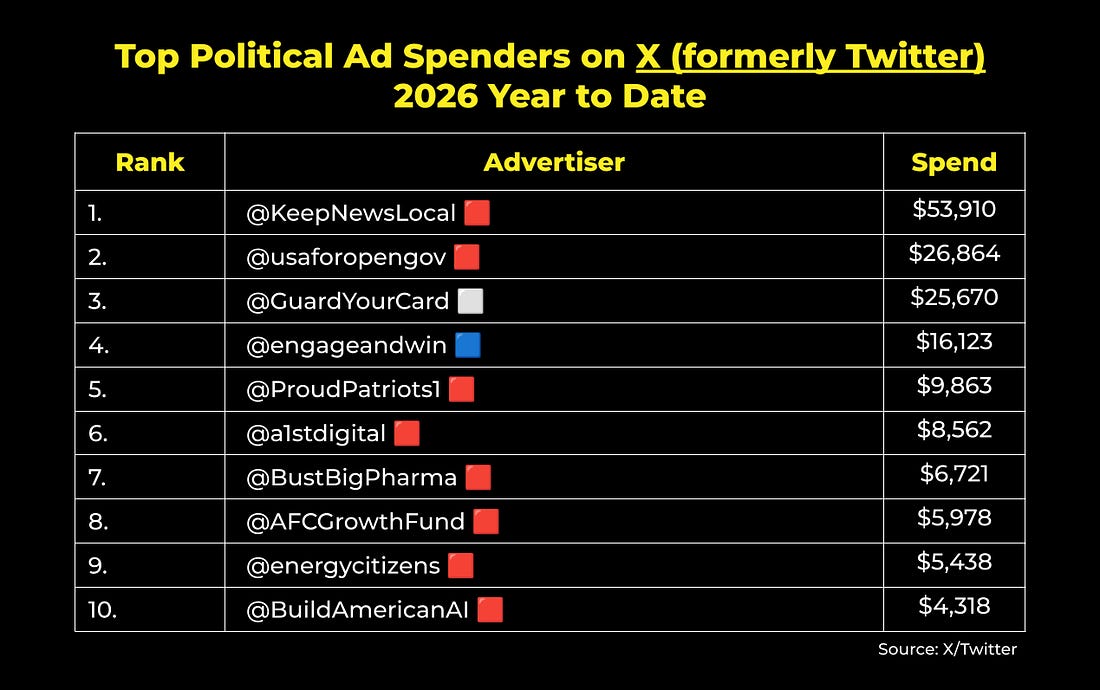

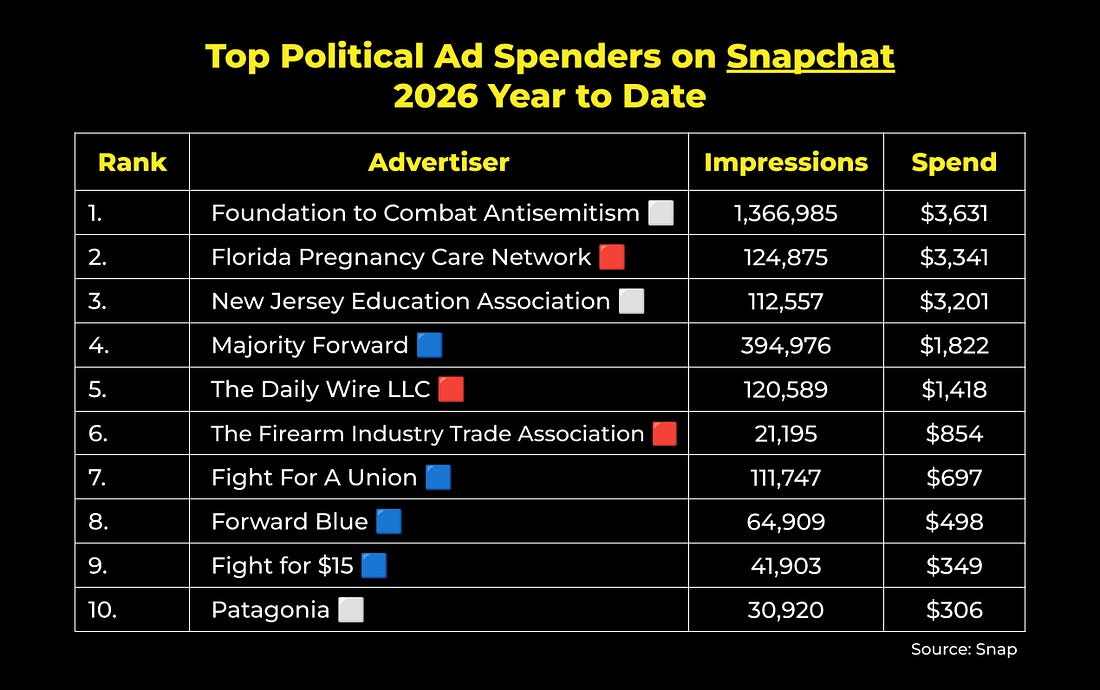

Scott here 👋; happy 2026! The news has been…a lot. It’s hard to believe this is only the third week in January. I hope the start of your year has had some bright spots! I’ve been looking forward to writing today’s piece. This is a part two from our story last year about the Rockbridge Network, which revealed how MAGA-world fundraises. This story focuses on another organization, 1789 Capital, founded by the same MAGA power brokers. 1789 Capital shows how MAGA profits. More below, but first… Digital ad spending, by the numbers:FWIW, U.S. political advertisers spent about $11.2 million on Facebook and Instagram ads last week. Here were the top ten spenders nationwide: PragerU came in at the top spot, which is fitting considering that they and 1789 Capital share deep financial ties to conservative heiress Rebekah Mercer. The Patriotic Prophet ran ads pitching “secret” knowledge about how to cash in on a law they claim Trump is about to change. And State + Local Election Alliance leaned on celebrity validators including Bradley Whitford to explain how donating to down-ballot races through its network is an effective way to blunt Trump’s power. Meanwhile, political advertisers spent just over $2.7 million on Google and YouTube ads last week. These were the top ten spenders nationwide: This week, two non-overtly political organizations cracked the top ten: Money Metals Exchange ran ads focused on selling gold and other precious metals and Iris Social Stock App marketed their social investing platform that follows the portfolios of public figures, including members of Congress. Additionally, the DNC, Sen. Mark Kelly, and Newsmax ran ads to build their fundraising lists, and the Dept. of Homeland Security continued their ghoulish behavior of running ads encouraging people to self-deport. On X (formerly Twitter), political advertisers in the U.S. have spent around $213,000 on ads in 2026. According to X’s political ad disclosure, here are the top spenders year to date: …and lastly, on Snapchat, political advertisers in the U.S. have spent around $17,000 on ads in 2025. Here are the top spenders year to date: ICYMI: Gloves Off is officially live!COURIER founder and publisher Tara McGowan kicked off her new show with Rep. Jasmine Crockett in a candid, yet hopeful conversation about power, courage, and what real leadership actually looks like. Stream the first episode now on YouTube, Spotify or Apple Podcasts.  1789 Capital: The Secret Financiers Turning Presidential Power Into ProfitThis week, we hit one full year of Trump 2.0. Over the past year, we’ve heard repeated claims that Trump and his family have profited off of the presidency. Today, we examine one way that may be happening: MAGA’s new venture capital arm and its investments into a “parallel conservative economy.” Let’s start with the basics. 1789 Capital was founded in 2022 by Omeed Malik, Chris Buskirk, and Rebekah Mercer. As you may remember, Buskirk also co-founded the Rockbridge Network and Mercer and Malik were among its major donors. The firm was created with the mission to promote “patriotic capitalism” which is conservative-speak for avoiding companies that care about ESG (environmental, social, governance) and DEI (diversity, equity, inclusion). In practice, their “parallel conservative economy” translated into an investment portfolio made up of artificial intelligence, defense, crypto, fin-tech, rare-earth minerals, spaceflight, alcohol/nicotine, and conservative media companies. A few of their portfolio companies include Substack (FWIW’s publishing site… yeah, we know), Juul, Polymarket, Happy Dad, Perplexity AI, BlinkRX, and unsurprisingly, many of Elon Musk’s companies, including SpaceX, xAI, Neurolink, and Twitter/X. What do these organizations have in common? You guessed it – the President of the United States. The Nelk Boys welcomed Trump onto their channel; now their alcoholic seltzer brand Happy Dad is backed by 1789 Capital. Musk (famously) donated millions to help elect Trump; now his companies have 1789 Capital investment. There’s overlap between the Rockbridge Network and 1789 Capital because many in the MAGA orbit share the same financial interests. And the man tying it all together is Donald Trump Jr. who, in late 2024, turned down a role in the White House to instead join 1789 Capital as a partner. Over the past year, the firm’s scale has ballooned. At the end of 2024, 1789 Capital had a modest $150 million assets under management (AUM). At the end of 2025, 1789 Capital crossed $2 billion in AUM – more than a 1200% increase. Proximity to power has its perks. Concentrating capital is not the only way 1789 Capital has benefited from Trump 2.0. Its portfolio companies have also gotten “lucky” recently with the federal government. Take Polymarket. In November 2024, the FBI raided the home of CEO Shayne Coplan and seized his phone and electronics as part of an investigation into whether the platform was operating without proper regulatory approval. Then in July 2025, the Dept. of Justice and the Commodity Futures Trading Commission formally ended their probes without bringing charges. Just a month later, it was announced that 1789 Capital was investing in Polymarket and that Don Jr. was joining their Advisory Board. Or take Vulcan Elements, a rare-earth minerals company. In August 2025, 1789 Capital disclosed its investment in Vulcan. Four months later, the company was awarded a $600 million loan from the US Department of Defense as part of a $1.4 billion deal to increase the supply of rare earth magnets. Obviously, ethics experts are not happy. An executive at the watchdog group Citizens for Responsibility and Ethics in Washington stated that while this kind of thing is “a problem that impacts the whole of government…there is no modern or historical comparison for what Don Jr. and the President are doing.” Despite objections, Don Jr., Buskirk, Malik, and their allies are expanding their reach. You won’t be surprised to learn that the three co-founded a swanky, new members-only club in Georgetown called the ‘Executive Branch.’ This invitation-only club is for cabinet secretaries and business moguls, costs over half a million dollars to join, and may just be the subject of a future FWIW. That’s it for today. Please let me know in a comment what stood out, what we missed, and if you’d be interested in a Part 3 focusing on the ‘Executive Branch.’ Thanks for reading! Are you a mission-aligned company or organization?COURIER would love to partner with you and amplify your work to our engaged audience of 190,000+ policy influencers and high-information active news consumers. Send a note to advertising@couriernewsroom.com for more. That’s it for FWIW this week. This email was sent to 25,322 readers. If you enjoy reading this newsletter each week, would you mind sharing it on X/Twitter, Threads, or Bluesky? Have a tip, idea, or feedback? Reply directly to this email. Support COURIER’s JournalismDemocracy dies behind a paywall, so our journalism is and will always be free to our readers. But to be able to make that commitment, we need support from folks like you who believe in our mission and support our unique model. |