| Read in browser | ||||||||||||||

Good afternoon from Los Angeles, wherever you may be. I just got back from 20 hours in Las Vegas for UFC 324, where the Paramount folks were very optimistic about their investment in mixed martial arts (and their pursuit of Warner Bros.). I am now bracing for Grammy week, followed by trips to Washington DC, New York and maybe Seoul. Reach out if we should meet. If you don’t already subscribe to this newsletter, please fix that here. Five things you need to know

Paramount’s endgame for Warner Bros.Netflix has agreed to buy Warner Bros. Discovery’s studio and streaming business in an all-cash deal for $27.75 a share. Warner Bros.′ board has unanimously approved the deal and its shareholders will vote on it in the next couple of months. That is the state of play. There is no bidding war. Netflix has won and Paramount Skydance has lost. Paramount has done an effective job of muddying the waters, creating a lot of confusion about what is actually happening. It’s also done a good job of annoying Warner Bros. and Netflix. But most of the recent maneuvers are just noise. The one tangible change was that Paramount prompted Netflix to alter its bid to all cash. But unless Warner Bros. shareholders reject the Netflix deal — a long shot — Netflix has won. That doesn’t mean Paramount is out of options. The most obvious step would be to offer more money. The Ellisons have lots of money and Netflix’s shareholders are already uncertain about this transaction. Paramount has said its offer isn’t its last and final, but it has yet to increase its bid. Even though Paramount believes its current bid to be superior to the Netflix terms, the Warner Bros. board doesn’t agree. Paramount can offer more money at any point before Warner Bros. shareholders vote on the Netflix deal. After they vote, it gets more complicated. Paramount could also wait and hope regulators block the deal. Many politicians have raised concerns about Netflix buying the Warner Bros. studios and HBO, which at a minimum will receive an extensive review in the US and Europe. This is a riskier approach — if the governments approve the deal, there’s little Paramount can do. Meanwhile, Paramount’s cable networks will shrink even more over that time. For the time being, Paramount can use the threat of regulatory rejection to try and convince shareholders to vote against the deal. Many readers and industry executives have expressed confusion about what is going to happen next. So I thought it would be good to answer some questions. Why does David Ellison want Warner Bros. so badly? David Ellison bought Paramount knowing it was a failing company. He has a plan to reinvigorate the business, but Warner Bros. would give him immediate scale in its library and streaming operations. Without Warner Bros., he faces a years-long building effort with uncertain prospects. Why aren’t more people pointing out the absurdity of a company (Paramount) with a $13 market cap attempting a hostile takeover of a $71 billion business (Warner Bros.) — especially when a $364 billion competitor (Netflix) already has a signed purchase agreement? It’s not any $13 billion company. It’s a $13 billion company backed by Larry Ellison, one of the richest men in the world. This is Larry and David Ellison against Netflix. Does Paramount’s lawsuit in Delaware have any credibility? Paramount filed a narrow lawsuit asking Warner Bros. to explain how it values its assets. Paramount wanted Warner Bros. to break down how it values its cable networks to illustrate why it thinks Netflix’s bid is superior. Warner Bros. outlined its valuation in a filing days later. Paramount would still like more information, but this is a low-stakes fight. Winning this lawsuit wouldn’t mean Paramount gets Warner Bros. Would approval by Warner Bros. shareholders seal this for Netflix? Pretty much — unless regulators block it. Paramount has threatened to nominate its own slate of directors to the Warner Bros. board. to block the Netflix deal. But the annual meeting, where directors are elected, will probably take place after Warner Bros. investors vote for the Netflix sale, meaning that strategy is unlikely to be pursued. Is Paramount relying too much on its relationship with the Trump administration? Paramount definitely saw itself as the only viable option at the start of the process, and not just because of politics. It was the only bidder interested in all of Warner Bros. That was a miscalculation. Yet Paramount remains convinced that the Netflix deal will get blocked, whether by Trump or in Europe. People with experience in Washington seem most worried about Netflix’s chances in Europe and believe the company will have to divest some assets there. Would Netflix agree to divest HBO if that is the main antitrust concern? Maybe in select territories. But not globally and certainly not the library. When will Paramount decide enough is enough and walk away? Could it go after a different company? Ask David Ellison, but there is no obvious Plan B. It is hard to see the Ellisons buying Warner Bros.′ cable networks (the part Netflix doesn’t want) as a consolation prize. Those don’t solve any of Paramount’s main problems and expose the company even more to a shrinking business. People need to stop comparing Lionsgate and AMC Networks to Warner Bros. Lionsgate isn’t in the same league as Warner Bros. — to say nothing of HBO — while AMC is a small collection of dying networks with a nice but small streaming business. Netflix co-CEO Ted Sarandos promises to keep Warner Bros. movies in theaters for 45 days. Should we believe that? Netflix will live up to Warner Bros.′ commitments to filmmakers, which should cover films on the slate for the next few years. After that, Netflix will release big titles theatrically but still make a lot of direct-to-streaming movies. How long they will remain committed to theaters is a guess. They may not even know themselves. Why should we care given the decline of theaters and the emergence of AI? Warner Bros is one of the most important companies of the last century. It has produced TV shows and movies that shaped global culture, such as Casablanca and Bonnie and Clyde, Friends and ER. CNN has been one of most important sources of news in the world for decades, while HBO has been perhaps the most influential TV network of the last 40 years, providing a platform for comedians, drawing filmmakers to the small screen and creating the very concept of prestige TV. The company isn’t as influential as it was 10 years ago. But it still matters and who owns it matters. As for AI, I urge you to watch clips of Ben Affleck talking about AI. This isn’t some closed-minded director ignoring the future. It’s someone who has used it. What is the possible impact of the Netflix takeover on Warner Bros.′ video-game division? It seems useful but not transformational for Netflix, which has thus far struggled in gaming. Warner Bros.′ gaming division has had problems of its own. How are all of the expiring guild contracts affected by the sale? This deal adds to the existential dread felt by many laborers in Hollywood. Pretty much everyone — filmmakers, executives and on — would rather nobody buy Warner Bros. But the guilds aren’t going to be able to demand that studios not merge as a condition of any contract. The best of Screentime (and other stuff)

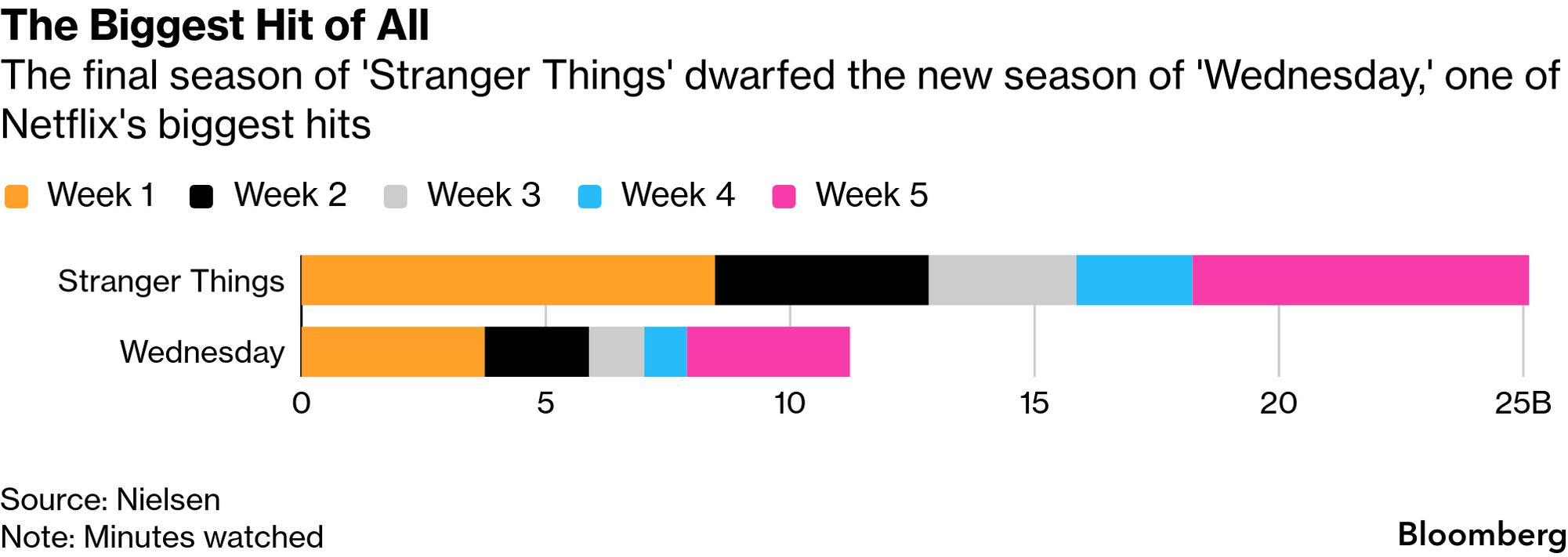

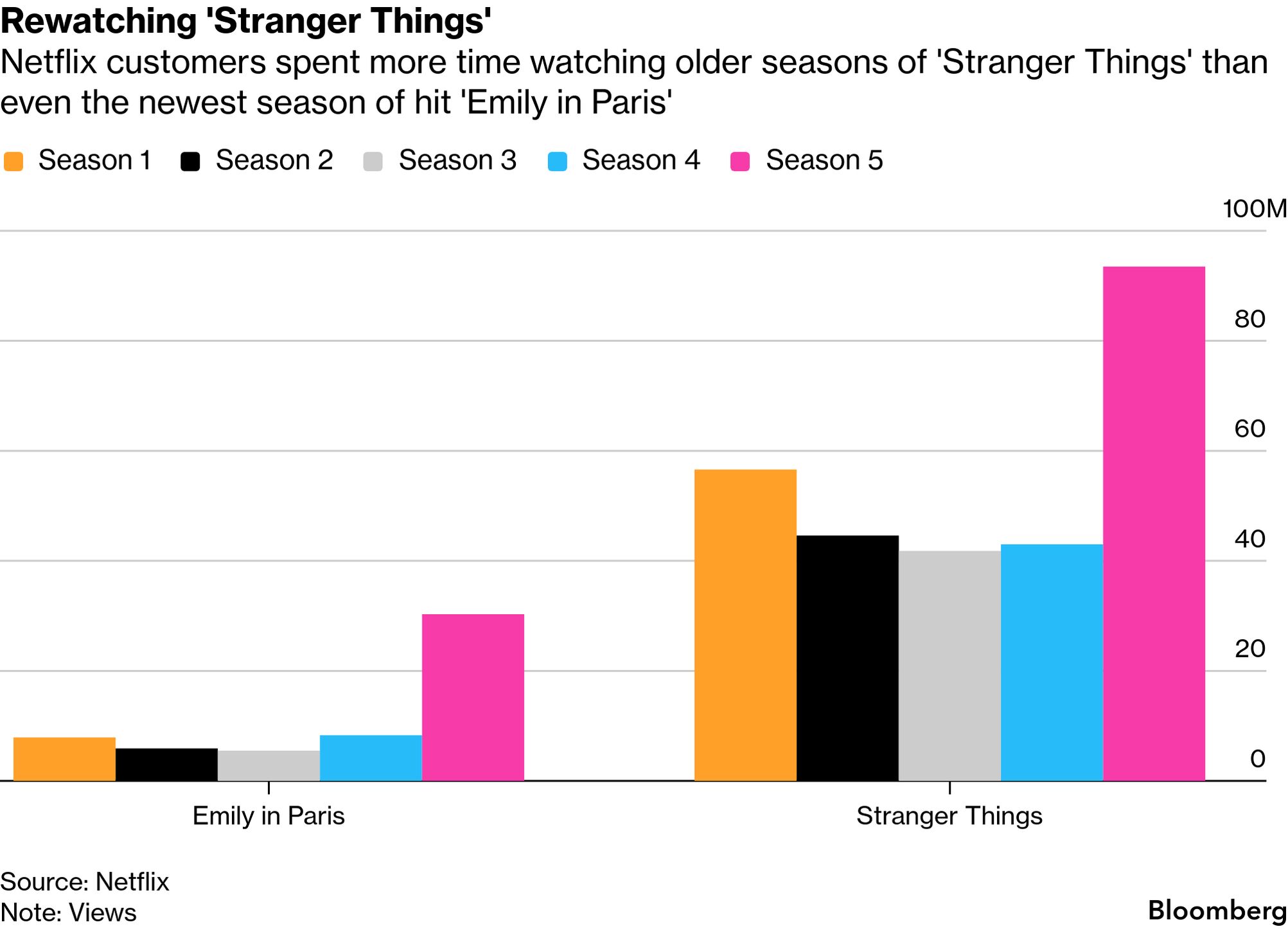

Netflix’s good news and bad newsNetflix shares sank after the company reported financial results for the fourth quarter of 2025. The company posted strong sales and earnings to close last year, but its forecast for 2026 was short on profit. Netflix cited two primary factors — a 10% increase in spending and costs related to its pending acquisition of the Warner Bros. studio and streaming businesses. Analysts were divided on how to interpret this. Some saw Netflix as pressing its advantage, spending more on programming and technology to push ahead of the competition. Others saw a company that is struggling to sustain its growth — and buying Warner Bros. to help solve that problem. Netflix expressed optimism about its first month of video podcasts — what else would management say? — and described both YouTube and Instagram as competition in TV. (This advances their argument that buying Warner Bros. isn’t anti-competitive.) The company also dropped its latest “engagement report.” We will take a deeper dive into the numbers at a later date, but it is worth reflecting on the utter dominance of Stranger Things. Stranger Things is more popular than every other big hitThe second season of Wednesday was Netflix’s most-watched season of TV last year. But let’s compare Wednesday with Stranger Things, which debuted at the end of the year. Both shows were dropped in batches, which is why you see a spike in week five.  Now some of this is because people are going back and watching older seasons of Stranger Things. Nielsen includes all seasons. So let’s compare Stranger Things with another Netflix hit that released its fifth season, Emily in Paris.  The Heated Rivalry surpriseOver the past six weeks, the TV show Heated Rivalry has been the talk of my weekly tennis game and many a social gathering. It has been the subject of incessant press coverage, with some calling it a word-of-mouth sensation. And yet, the show didn’t appear in Nielsen’s weekly rankings. The Canadian hockey romance is less popular than Mayor of Kingstown and PAW Patrol. This is a classic coastal hit — buzzy and beloved by the media, but not a mass-market phenomenon. It’s still a huge success, especially considering how cheap it was for HBO Max. The streaming service is now negotiating for the rights to a second season — and the price has gone up. The Warner Bros. turnaround is almost completeSinners earned 16 Oscar nominations — the most of any movie in history. It will contend with One Battle After Another, the Paul Thomas Anderson film that has been seen as the favorite. Both movies were released by Warner Bros. A win on Oscar night will cap one of the most remarkable turnarounds in recent Hollywood history. Last March, Warner Bros. Discovery CEO David Zaslav was looking to replace studio chiefs Mike De Luca and Pam Abdy. Then they released a half dozen No. 1 films in a row — seven if you count F1 — and captured many major awards. Deals, deals, deals

Weekly playlistDare I say that I like the new Harry Styles song “Aperture” despite its terrible title? The British pop star is setting out on a new tour with unconventional routing. He’s playing in only seven cities, aping the residency strategy he used last time. But unlike that one, which featured long stays in several cities, he’s playing more than half of his dates at Madison Square Garden in New York — 30 shows in all. More from BloombergGet Tech In Depth and more Bloomberg Tech newsletters in your inbox:

We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Screentime newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|