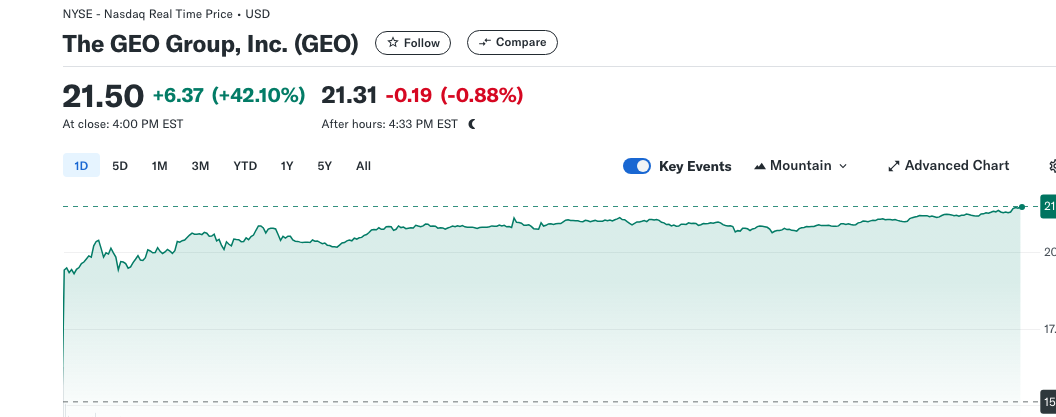

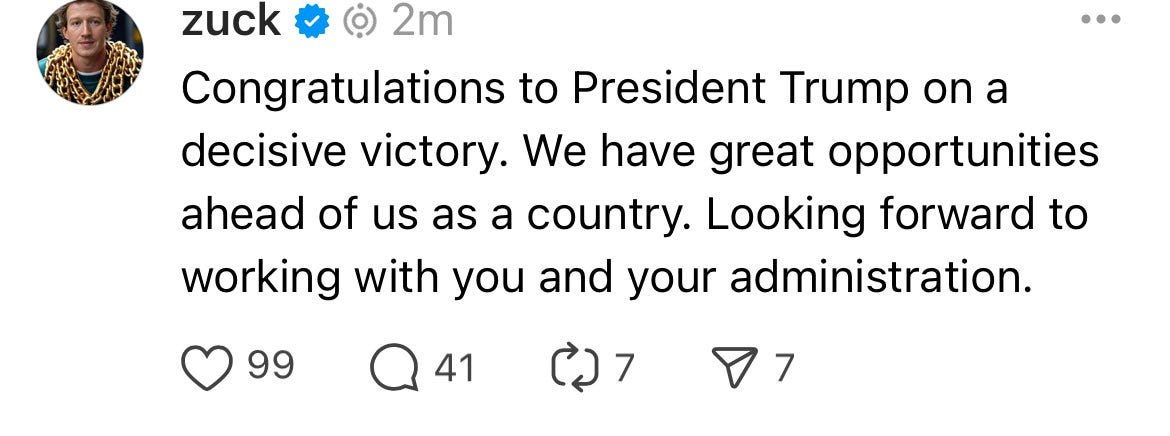

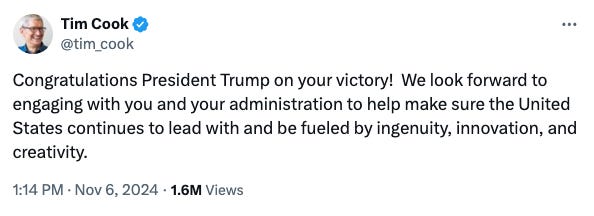

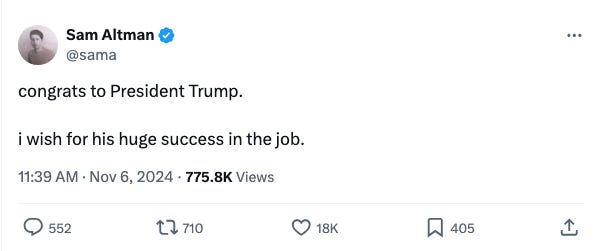

Wall Street Celebrates a Coming Trump Merger BoomAirline lobbyists, CNBC anchors, bankers can't hide their excitement as media CEOs discuss their 'desperation' to consolidate. And a House GOP leader floats a consolidation-friendly proposal.Welcome to BIG, a newsletter on the politics of monopoly power. If you’d like to sign up to receive issues over email, you can do so here. For the past three and a half years, we’ve had a political experiment. What happens if you take a few small antitrust and regulatory agencies with a cumulative budget of $1 billion, and run them on populist lines? The government’s discretionary budget is around $2 trillion, so we’re talking .05% of President Biden’s resources dedicated to addressing corporate power. The answer, as it turns out, is both a lot, and too little. For a time, we paused the consolidation fervor and sketched out a possible future in which our public institutions work for us. But it was just a sketch. Corporate profits are at an all-time high, and dissatisfaction with the economy is overwhelming. Wall Street still controls far too much of the Democratic Party, thwarting most policies, and when unable to thwart them, managing enough of the party apparatus so that the consultants and spokespeople refuse to talk about it. The voters responded in turn, rejecting Kamala Harris and the Democratic Party in a resounding fashion. And yet, at the same time, all over the country, voters elected Republican officials, while voting for ballot initiatives mandating paid sick leave and increasing the minimum wage. In Florida, a marijuana legalization initiative failed, and the messaging against it was all about how it would consolidate the industry into the hands of a few. Basically, voters said they distrust Democrats. And they are correct. Wages dropped in 2022-2023, food prices increased at historically large rates, borrowing costs jumped, large swaths of the safety net were cut, and none of these were reflected in the inflation statistics that economists use to judge how the economy is. It’s a difficult for most Democrats to hear this reality, because they’ve been told endlessly by economists and experts how great things are. So one conclusion I heard all over the place is that doing good things doesn’t bring political support, when the real conclusion is that a lot of busywork that doesn’t affect reality on the ground doesn’t bring political support. At any rate, the results are conclusive. I’ll have a longer analysis piece of how and why this agenda failed, and in what part of it anti-monopolists could have done better. But for now, let’s talk about the economic consequences of Trump’s election and a likely Republican House and Senate. One ominous tidbit is in a letter from House Republican and possible leader Steve Scalise, who proposed as one legislative priority in the first 100 days that he would seek to keep “government out of the way so innovation and the startup community can flourish.” It’s not clear what he means, as there are also all sorts of regulatory complaints they have. But venture capitalists have been enraged over their inability to sell their firms to big tech. Another tidbit is that Warner Discover CEO David Zazlov told investors the new administration could offer "an opportunity for consolidation that would provide a positive and accelerated impact on this industry." And finally, there’s chatter that the blatantly illegal LIV Golf-PGA Tour deal is going to move through, as long as Elon Musk is involved somehow. So the expectations are that Trump will run a crony-focused antitrust policy. Is that right? We don’t know. The End of the BeginningOne way to understand what Trump is likely to do is to look at the financial markets, which are absolutely pulsing with excitement. Here’s a useful segment yesterday with CNBC anchors David Faber and Jim Cramer, where Faber talks about his chats with various CEOs. These executives are “strapping in” to mergers and acquisitions, floating mega-deals like Comcast buying Charter, Exxon merging with Chevron, banks consolidating, and Amazon and Google once again going out and making large acquisitions. There is, he noted, a “desperation for consolidation” in corporate America after the last three years of restrictions. And the stock market reflected this dynamic, up 1500 points. A whole host of certain targeted industries saw even more significant financial changes. The stock of the Geo Group, a large private prison firm, jumped by 40%. Crypto exchange Coinbase, whose revenue has fallen by 75% over the last three years, went up by 31%. Bank stocks skyrocketed, especially Wells Fargo which had been under a strict order from the Fed over its various fake account scandals, and Discover, which is being pursued by Capital One in an acquisition. M&A specialists Moelis & Company, Perella Weinberg, Evercore, and Lazard all went up by around 15%. J.P. Morgan, private equity giant Apollo, and a host of financial stocks tied to Fannie Mae and Freddie Mac were also huge winners. Investors are betting we could see the number of banks in America decline from 3400 to a few hundred or so, and a lot of deregulation in the industry. Meanwhile, big tech CEOs tripped over themselves to congratulate Trump on his victory, making especially sure that they used Elon Musk’s X platform to convey the message. Airline lobbyists, which has been under special scrutiny, also expressed joy, as their stocks jumped on the prospect of consolidation and more fee income. And finally, populist Democrats and unions reacted with rage. “It should come as no great surprise,” said Senator Bernie Sanders, “that a Democratic Party which has abandoned working class people would find that the working class has abandoned them.” “The Democratic Party has continued to fail to prioritize a strong, working-class message that addressed issues that really matter to workers,” Painters President Williams said. “The party did not make a positive case for why workers should vote for them, only that they were not Donald Trump.” “Corporate CEOs are intent on dividing us against each other so they can drive down wages and cut corners on safety to boost profits for big investors. We cannot let that happen,” Communications Workers President Claude Cummings said. “It’s time for Washington, DC to put up or shut up, no matter the party, no matter the candidate. Will our government stand with the working class, or keep doing the bidding of the billionaires? That’s the question we face today. And that’s the question we’ll face tomorrow. The answer lies with us. No matter who’s in office,” United Autoworkers union President Shawn Fain added. President-Elect Trump’s First ChallengeIs Trump going to govern as an economic populist? We’ll know soon enough, as corporations announce big deals and Trump sketches out his antitrust framework in response. Will he side with big business, or with his small business and working class voters? We’ll also see how the new rump Democratic Party responds. Will they ignore economic power, as they have mostly been doing? Or will they center it politically? I’m pretty angry about this turn of events, at an administration that allowed some populist antitrust and regulatory choices, but centered most of its policy formation around deferring to the Federal Reserve’s Wall Street friendly high interest rate choices, and spending money on unpopular foreign conflicts. That said, in 1974, Republicans did so badly that it was a serious question among some political observers whether the Republican Party and big business would continue to exist. Over the next ten years, however, both parties realigned radically away from that framework. Whatever happens, there are always opportunities, as private litigation and state level enforcement are real enough, and there’s always a possibility the Trump administration goes in a surprising direction on competition. That’s what some of my contacts on the right hope. And at some level, there’s now no putting the toothpaste back in the tube on competition policy. We’ve tasted the goods, and we’ll always remember the flavor. Thanks for reading. Send me tips on weird monopolies, stories I’ve missed, or comments by clicking on the title of this newsletter. And if you liked this issue of BIG, you can sign up here for more issues of BIG, a newsletter on how to restore fair commerce, innovation and democracy. If you really liked it, read my book, Goliath: The 100-Year War Between Monopoly Power and Democracy. cheers, Matt Stoller This is a free post of BIG by Matt Stoller. If you liked it, please sign up to support this newsletter so I can do in-depth writing that holds power to account. |